Updated: 10 Jul, 2024

Prime Minister Anthony Albanese has confirmed that the Labor Party’s Help to Buy Scheme is scheduled to commence in 2024. This announcement was made during the Labor Party’s National Conference, where all states and territories reached a consensus to advance the necessary legislation for the nationwide shared equity initiative. Originally unveiled during the federal election campaign, the Help to Buy Scheme was first slated for a 2023 launch, before being pushed back to its current 2024 start date.

What Is The Help To Buy Scheme?

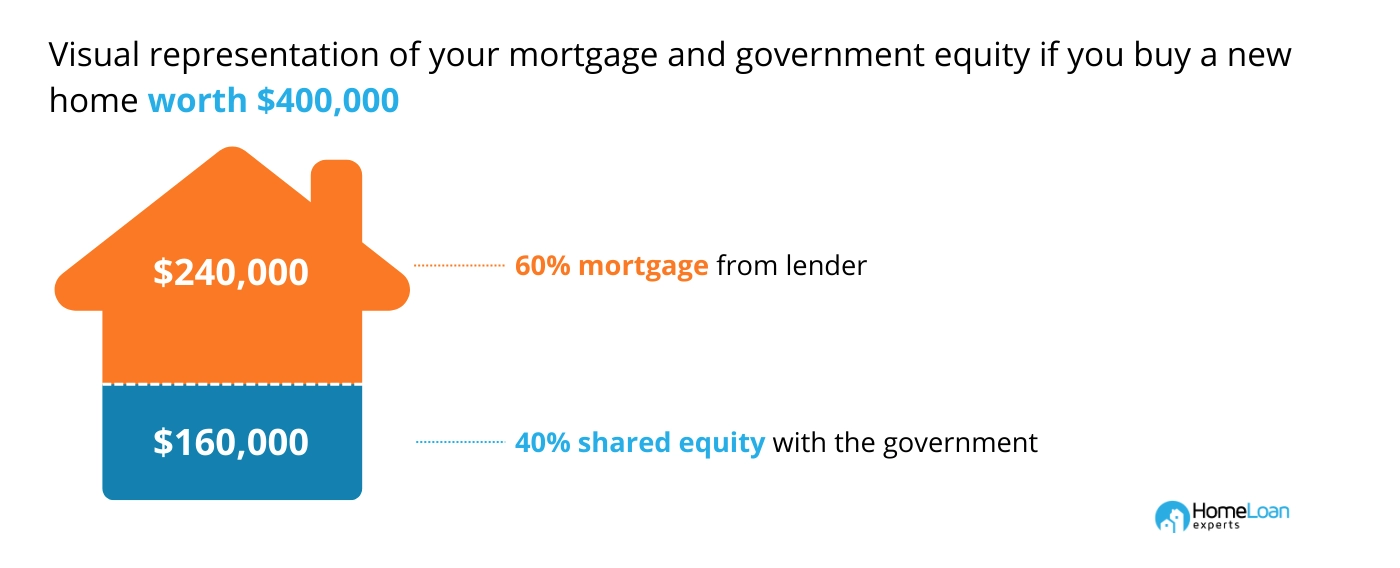

It is a shared-equity scheme where the government will provide an equity contribution to help low- and middle-income families. The government’s contribution will cover up to 40% of the property price for new homes and 30% for existing properties. Eligible participants will need only a 2% deposit, and they will not have to pay Lenders Mortgage Insurance (LMI). There are income caps, which are $90,000 for single applicants and $120,000 for joint applicants. Read our page on the Help to Buy Scheme for more information.

Should I Wait For The Scheme To Take Effect?

You don’t need to wait until 2024 to get the government to help you buy a home. There are other nationwide and statewide schemes available that can help you buy your first home sooner.

Home Guarantee Scheme

The Home Guarantee Scheme (HGS) is an Australian Government initiative to help eligible homebuyers purchase sooner. It is administered by the National Housing Finance and Investment Corporation (NHFIC).

It is a guarantor scheme in which the government guarantees a portion of a loan so eligible homebuyers avoid paying Lenders Mortgage Insurance (LMI), even with a deposit as low as 2% of the property value.

There are three schemes under the Home Guarantee Scheme:

Grants For First Homebuyers

First-home buyer grants are also available. These grants range from $10,000 to $30,000, with eligibility criteria varying across different states and territories.

Other Shared-Equity Options

In addition to the federal government’s Help to Buy Scheme, certain states have introduced their own shared-equity initiatives:

Other Options

There are also loans available that can help you purchase a home without paying much in upfront costs:

- A guarantor home loan is the best way to borrow 105% without paying LMI.

- No-deposit and low-deposit (as low as 5%) home loans are available.

We're Here To Help

Our mortgage brokers are experts at helping you get approved for any of the schemes and grants or home loan options. We’ve helped thousands of first-home buyers realise their dreams of home ownership. You could be next.

Call us on 1300 889 743 or complete our free online assessment form today.