Updated: 26 Jul, 2024

Along with getting married and starting a family, buying your first home is a major milestone in life. There are a lot of things to consider including where you want to live and what type of property you want to live in. That’s the fun stuff.

What a lot of people don’t put as much thought into is the type of home loan they choose and what exactly they’re trying to achieve.

Let’s face it, you’ll be borrowing more than you ever have before so it pays to spend a little time to figure out what you need out of the loan.

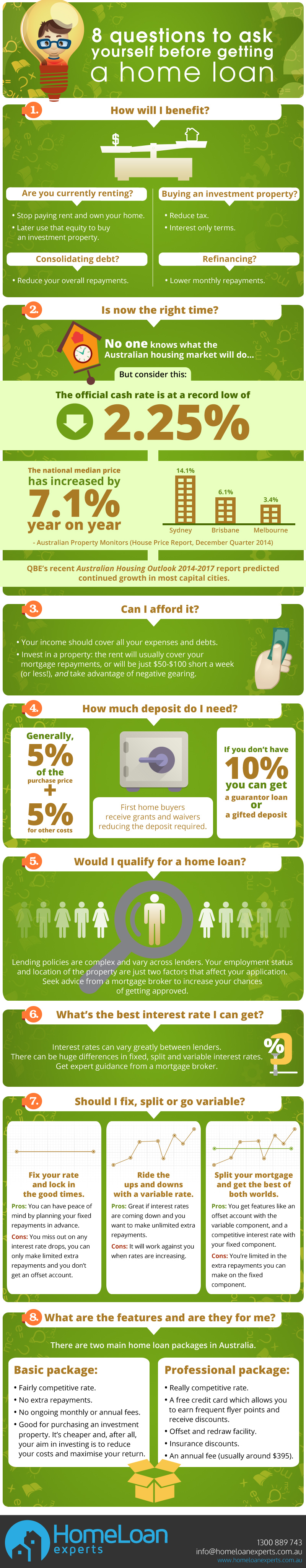

Here are 8 questions to think about:

Would I qualify for a home loan?

Lending policies can be very complex and vary from lender to lender. Many things you think would be OK with your situation are actually not, such as your employment status and where the property is located.

What will I achieve by getting a home loan?

This will vary depending on your current situation and your financial goals.

Are you currently renting?

- You can stop paying rent

- You can own your own home.

- You can later use that equity to buy an investment property.

Do you want to invest in property?

- Property is an asset which appreciates in value.

- There are negative gearing benefits, which means minimal monthly repayments.

- Some lenders will offer 10-15 year interest only terms if you’re in a strong financial position.

Want to consolidate your debt?

- Bundle your debts and reduce your overall repayments.

Are you refinancing?

- Get lower monthly repayments

Should I wait or should I act now?

Will house prices come down? Will interest rates drop?

The reality is, no one knows. Consider this though:

- The official cash rate has been at an historic low since August 2013, and it fell even further in February from 2.50% to 2.25%.

- Australian Property Monitors House Price Report, December Quarter 2014 found that the national median price had increased by 7.1% year on year, with Sydney (▲14.1%) leading the other capital cities followed by Brisbane (▲ 6.1%) and Melbourne (▲ 3.4%)

- QBE’s recent Australian Housing Outlook 2014-2017 report predicted continued growth in all capital cities – apart from Canberra and Perth – over the next three years to 2017.

Can I afford the loan?

To qualify for a mortgage, your income should outweigh your living expenses and debts including the new mortgage. If you can’t afford an owner-occupied property, have you considered investing?

In most cases, the rent will cover your mortgage repayments and, if not, you might just have to pay as little as $50-$100 a week (or less!). Plus, you can take advantage of negative gearing benefits.

How much deposit do I need?

Generally, you need 5% of the purchase price plus 5% to complete the purchase. These completion costs include stamp duty, legal fees and bank set up charges.

If you don’t have 10%, you can still get a home loan with a guarantor or a gifted deposit.

First home buyers may be eligible for a grant or stamp duty waiver, further reducing the deposit amount required.

What’s the best interest rate I can get?

Interest rates are advertised all the time and they can vary greatly between lenders. There can also be a massive difference in interest rates depending on whether you fix, split or choose a variable rate mortgage.

The trick is getting expert guidance from a mortgage broker.

Should I fix, split or go variable?

Fix your rate and lock in the good times

- You can choose to fix your interest rate for 2, 3 or 5 years, and some lenders will even allow you to lock your rate for up to 10 years.

- You miss out on any further drop in your bank’s variable interest rate, you’re generally limited in making a maximum of $10,000 per year in extra repayments and you don’t get an offset account.

Ride the ups and downs with a variable rate

- Your rate will move with the bank’s variable rate. Great if interest rates are coming down and you want to make unlimited extra repayments.

- It will work against you when rates are increasing so you should try to make as many extra repayments as you can.

Split your mortgage and get the best of both worlds

- You get added features like an offset account, redraw facility and a credit card with the variable component and, if interest rates do drop, you have the opportunity to fix that part of your loan. You can get a pretty competitive interest rate with your fixed component as well.

- You’re limited in the extra repayments you can make on the fixed component.

What are the features and are they for me?

There are two main home loan packages in Australia.

Basic package

- Fairly competitive rate.

- No ongoing monthly or annual fees.

- Good option for people who already have an owner-occupied property and want to purchase an investment property. It’s cheaper and, at the end of the day, your aim in investing is to reduce your costs and maximise your return.

- You can’t make extra repayments.

Professional package

- Really competitive rate.

- You get an offset and redraw facility.

- You’re eligible for insurance discounts.

- The major downside is an annual fee (usually around $395).

Not sure how to answer all of these questions?

A mortgage broker can actually guide you through all of this and ensure that you’re getting the right home loan to best fit your situation.

Please call 1300 889 743 or fill in our free assessment form today.