Updated: 26 Dec, 2024

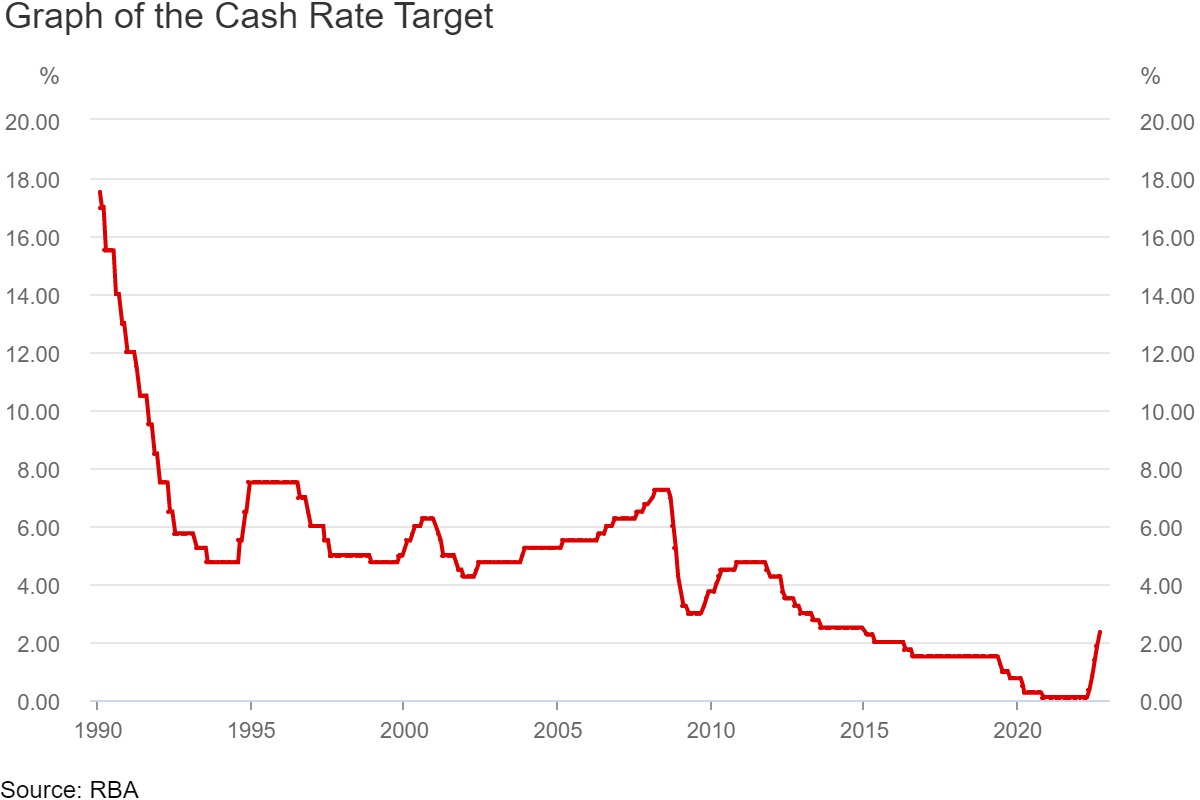

The Reserve Bank of Australia (RBA) increased the cash rate by half a percentage point today, taking it to 2.35%.

How Does The Cash Rate Increase Affect My Interest Rate?

Lenders add a margin to the official cash rate to determine the variable interest rate they lend to customers. So if you have a variable interest rate, it will almost certainly go up with the cash rate increase.

How Much Is My Monthly Repayment Going to Increase?

The following chart shows how much the extra half a percentage point in interest will cost homeowners, based on the size of their loan. (These example loan repayments were determined using our repayment calculator, based on the lowest variable rate we can offer over a 30-year term, as of 6 September 2022. Rates are subject to change from this date.)

| Loan Amount | Before Increase (3.19%) | After Increase (3.69%) | Difference |

|---|---|---|---|

| $500,000 | $2,160 | $2,299 | $139 |

| $600,000 | $2,592 | $2,758 | $166 |

| $700,000 | $3,023 | $3,218 | $195 |

| $800,000 | $3,455 | $3,678 | $223 |

| $900,000 | $3,887 | $4,137 | $250 |

| $1million | $4,319 | $4,597 | $278 |

How High Will Interest Rates Go?

“The psychological impact of a rate increase is immediate; however, the financial impact slowly builds over many months. For this reason, the RBA wants to be cautious, to avoid overshooting the mark and being in a position where it needs to decrease rates.”

He also pointed to at least one sign that interest rates might ultimately not go as high as many once thought.

“We’ve seen several banks reduce their fixed rates in the last month, which indicates that the money market does not expect rate rises to be as significant as they were forecast to be a few months ago,” Dargan said.

What To Do Now

An increase in a bank’s standard variable rate also raises the rate used for determining serviceability, which is the interest rate on an individual loan plus the buffer rate. The higher this number goes, the less people can borrow. We did the maths on how a 0.5-point rate hike affects your borrowing power. A person earning $100,000 would see a $24,100 reduction in their borrowing capacity. A person making $150,000 would experience a decrease of $35,500, while a person making $200,000 would see a reduction in borrowing power of $47,400.

We’ve outlined some tips to prepare for a rate rise. We can guide you through the right steps to prepare for increases, whether through refinancing or simply managing your home loan more effectively.

Our mortgage brokers know how to get you the best deal as interest rates rise. We can help you refinance to keep your home loan’s interest rate competitive. Call 1300 889 743 or enquire online to speak to one of our expert brokers today!