What Is The Regional First Home Buyer Guarantee?

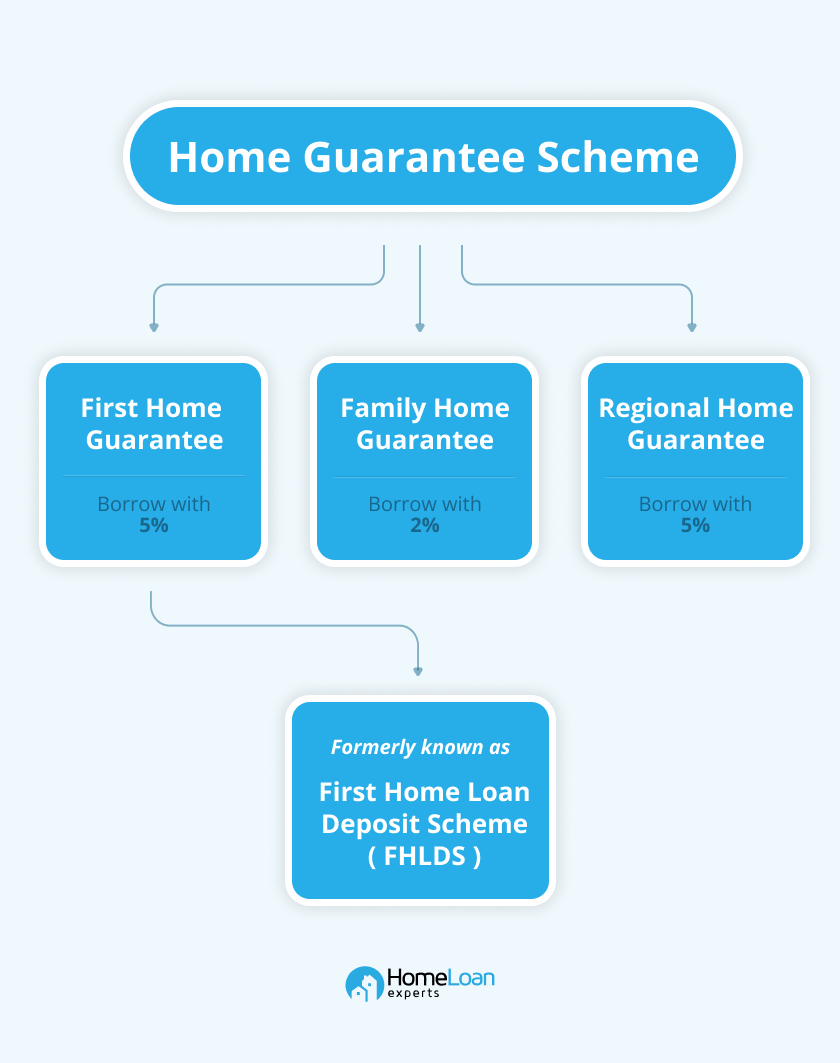

The Regional First Home Buyer Guarantee is an expansion of the existing First Home Guarantee (formerly known as the First Home Loan Deposit Scheme). If you have a deposit as small as 5% of the property value, you can buy or build a property in a regional area without paying Lenders Mortgage Insurance (LMI) LMI is usually applicable when you’re borrowing more than 80% of the property value. Under the Regional Home Guarantee, however, you can borrow up to 95% of the property value without paying LMI. The government will guarantee 15% of the value of your loan.What Is A Regional Area?

The National Housing Finance and Investment Corporation (NHFIC) defines a regional area as:- Statistical Area Level 4 areas in a state or the Northern Territory that are not a capital city of that state or territory; and Norfolk Island; or the territories of Jervis Bay, Christmas Island or Cocos (Keeling) Islands.

- The ACT and greater capital city areas of each state and the Northern Territory are excluded from the RFHBG.

When Will The Regional First Home Buyer Scheme Be Available?

Applications for the Regional First Home Buyer Scheme are being accepted now; the scheme launched on 1 October 2022 and will run through 30 June 2025. There are 10,000 places each year.Home Guarantee Scheme Expands Eligibility For 2023-24

The federal government has announced changes to the Home Guarantee Scheme. The changes will greatly expand the number of people eligible to participate in the scheme. From 1 July 2023:- Friends, siblings and other groups of family members can jointly apply for the First Home Guarantee and Regional First Home Buyer Guarantee.

- Non-first-home buyers who have not owned property during the last 10 years can also apply.

- Borrowers who are single legal guardians of children – such as their aunts, uncles and grandparents – can apply for the Family Home Guarantee.

- Australian permanent residents are eligible to apply for all three schemes: First Home Guarantee, Regional First Home Guarantee and Family Home Guarantee.

What Are The Eligibility Requirements?

- You must be an Australian citizen and at least 18 years old

- You must not have owned a home before

- You must buy outside of a capital city area

- You must have been living in the region where the property is located, or the adjacent area, for 12 months

- Your annual income must not exceed $125,000 for individuals or $200,00 for couples

- The price of the property must not exceed the caps

- You must buy the property as a principal place of residence and not an investment.

What Are The Price Caps For The Guarantee?

| State | Regional Centre* | All Other Regional Areas |

|---|---|---|

| New South Wales | $900,000 | $750,000 |

| Victoria | $800,000 | $650,000 |

| Queensland | $700,000 | $550,000 |

| Western Australia | – | $450,000 |

| South Australia | – | $450,000 |

| Tasmania | – | $450,000 |

| Territory | All Areas |

|---|---|

| NT Regional | $600,000 |

| Jervis Bay Territory & Norfolk Island | $550,000 |

| Christmas Island & Cocos (Keeling) Islands | $400,000 |

| ACT | Not applicable |

Frequently Asked Questions (FAQs)

What Property Types Can I Buy?

You can buy the following types of properties under the Regional First Home Buyer Guarantee:

- An existing house, townhouse or apartment

- A house and land package

- A land and separate contract to build a home

- An off-the-plan apartment or townhouse

How Can I Prove I’m A Regional Buyer?

You will need to provide the following documents to prove you’ve been living in a regional area:

- A copy of utility notices for the preceding 12-month period

- A copy of a rental agreement for the preceding 12-month period

- A copy of your recent Notices of Assessment that can validate residence over the preceding 12-month period

- If the borrower is a member of the Australian Defence Force, an official statement confirming any posting required in the course of the person performing their duties over the preceding 12-month period

What If My Partner Has Not Lived In A Regional Area?

Couples can apply as long as one member has lived in a regional area for the last 12 months.

- For example, if you’ve lived in Orange (NSW) for 13 months, but your partner has lived there for only five months, you can apply as a couple.

- However, if one of you lived in Orange (NSW) for five months and the other lived in Sydney for three years, then you’re not eligible, as neither borrower has lived in the regional area they are purchasing in for the preceding 12-month period.

Where Can I Get More Information Regarding The Regional First Home Buyer Guarantee?

You can get information regarding the Regional First Home Buyer Guarantee from the NHFIC’s website:

Who Are The Participating Lenders For The Regional First Home Buyer Guarantee?

There are multiple participating lenders – including three major lenders – where you can apply for the Regional First Home Buyer Guarantee:

- Commonwealth Bank

- NAB

- Westpac

- Australian Military Bank

- Australian Mutual Bank

- Auswide Bank

- BankSA

- Bank Australia

- Bank First

- Bank of Heritage Isle

- Bank of Melbourne

- Bank of Us

- bcu

- Bendigo Bank

- Beyond Bank Australia

- Border Bank

- Community First

- Credit Union SA

- Defence Bank

- Firefighters Mutual Bank

- G&C Mutual Bank

- Gateway Bank

- Great Southern Bank

- Health Professionals Bank

- Indigenous Business Australia

- Illawarra Credit Union

- IMB Ltd (trading as IMB bank)

- Mortgageport

- MyState Bank

- Newcastle Permanent Building Society

- P&N Bank

- People’s Choice

- Police Bank

- QBANK

- Queensland Country Bank

- RAMS

- Regional Australia Bank

- St.George

- Teachers Mutual Bank

- The Mutual Bank

- UniBank

- Unity Bank Limited

- WAW

What Other Schemes Are Available?

- First Home Guarantee (formerly known as the First Home Loan Deposit Scheme): For first-home buyers with a deposit of 5%.

- Family Home Guarantee: Single parents with dependants can buy or build a new home with a deposit of just 2% of the property value.

- First-home buyers can get grants and stamp duty concessions

- With a guarantor, you can borrow up to 105% of the property value to buy a home.

- There are low deposit and no deposit home loans available.

Alan Hemmings, CEO of Home Loan Experts, expressed approval of the changes. “The expansion of the First Home Buyer Guarantee and Family Guarantee Scheme are welcome, certainly with the First Home Buyer Guarantee scheme we have seen places fill very quickly so expanding the number of opportunities for first home buyers is a great outcome,” Hemmings said. “The addition of the Regional Home Guarantee is also welcome,” he continued. “This will help first-home buyers and buyers who have been out of the market for more than five years get into their own home. “One thing for the government to consider with the expansion of these schemes is expanding the number of lenders who are participating as well. Given the increased number of places, expanding the range of lenders available will help maintain service levels and provide a great customer-service outcome for brokers and lenders alike.