Updated: 09 May, 2025

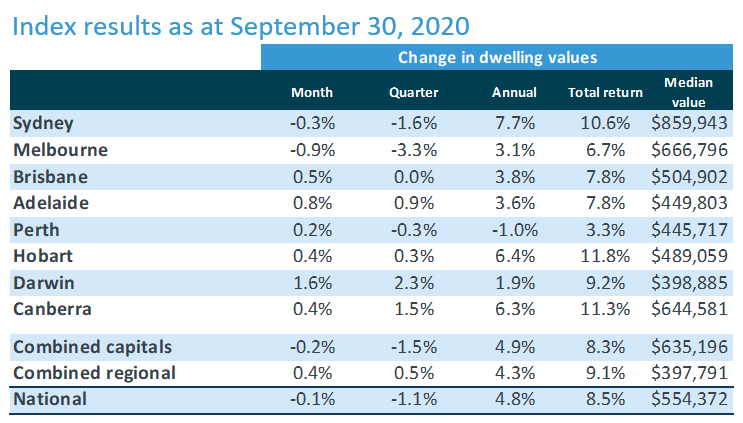

Falling home values in Sydney and Melbourne pushed the national housing market into its fifth consecutive month of decline.

- Six of the eight capital cities had a rise in their home values over the month. Only Sydney and Melbourne recorded a decline of 0.3% and 0.9% in September.

- There was a 0.1% drop in dwelling values, which is the smallest decline since since May 2020.

- There are fewer distressed listings, and the market is absorbing new listings.

- The auction market is showing some strength, with capital city clearance rate at the 60% range in September.

- The bottom 25% of the properties in the market are still fairing better than the upper 25% of the properties in the market. That is to say premium properties dropped by 2.6% whereas more affordable properties only dropped by 0.4%.

According to Tim Lawless, CoreLogic head of research, “By far the weakest result across the capital cities, Melbourne housing values were down 0.9% in September. Since peaking in March, Melbourne values are down 5.5%. With restrictions starting to lift and private home inspections once again permitted, we expect to see activity lift in October.“

Sydney’s rate of decline has been easing since July, while the other remaining capital cities have returned to some level of growth.

Why are regional markets more resilient than capital cities?

Regional markets are still outperforming capital cities.

Combined regional home values only slipped 0.8% since March, while capital cities dropped by 2.6%.

According to CoreLogic, regional markets are more resilient to the impact of COVID-19 due to the following reasons:

- Regional areas were not experiencing the same growth conditions as capital cities before COVID-19.

- Home values in regional areas are more affordable and did not have a high base to fall from.

- Buyers are looking for properties in regional areas than capital cities, especially areas adjacent to larger capital cities.

- Remote work arrangements brought on due to the pandemic is also supporting demand in regional areas.

- People are looking for lower-density housing options.

How will the 2020 budget impact the housing market?

An additional 10,000 places are available for the First Home Loan Deposit Scheme. The “New Home Guarantee” is only available for first home buyers to build or purchase a new home.

There is a boost to housing and infrastructure investment with $1 billion going towards affordable housing and over $10 billion towards infrastructural development.

Read our 2020 budget blog for more information on how it impacts home buyers and property investors.

Should I buy property now?

With the government committed to bringing Australia out of the COVID-19 recession, there are incentives available to property investors and home buyers.

The low-interest rate environment and fewer competition from buyers could get you a bargain when you buy your home. Sellers are also willing to negotiate since there are fewer buyers in the market.

Getting pre-approved for a home loan to know how much you can afford should be your first port of call.

Our mortgage brokers are here to help!

Call us on 1300 889 743 or fill in our free assessment form, and we’ll help to achieve your property goals.