Updated: 29 May, 2025

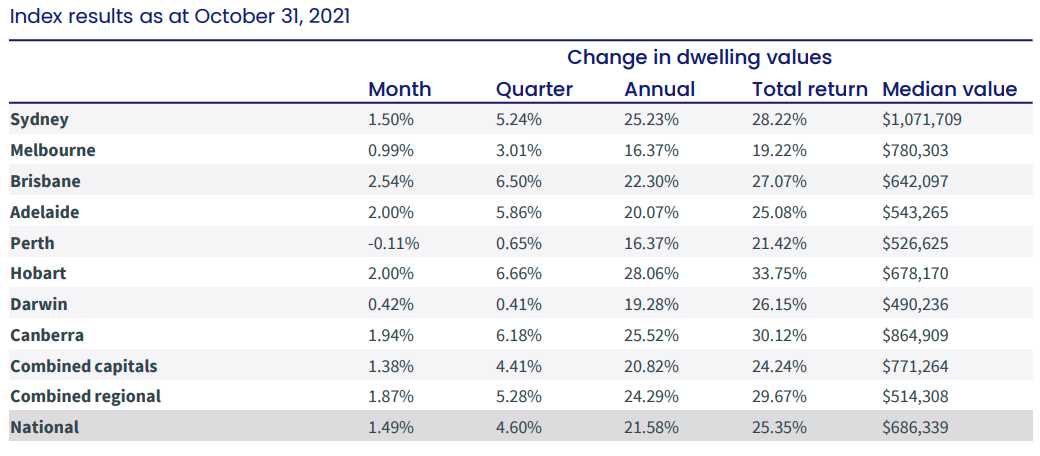

CoreLogic data shows housing values rose 1.5% in October 2021. However, Australia’s property market is slowly experiencing a loss from its peak monthly growth momentum of 2.8% in March 2021. Now, the growth rate is at 1.5%.

Even though the monthly pace of growth is easing, the annual trend is rising. Nationally, home values were 21.6% higher over the year to October 2021. Half of the capital cities recorded an annual growth rate of more than 20%.

Figure: CoreLogic Home Value Index, October 2021

Regional Market Still Growing

Regional markets recorded a stronger upwards trajectory than capital cities. Housing values in regional Australia were 1.9% higher in October, compared with a 1.4% rise in capital city values.

Regional Tasmania led the pace for annual capital gains, with housing values rising 29.1%. Across other regional markets, NSW and Queensland led the pace of capital gains, at 2.1% and 1.9%, respectively. Only Western Australia’s regional market experienced a fall (-0.1%) in housing values.

Unit rents in regional markets experienced higher quarterly growth than units, 2.3% to 2.1%.

What Happened To Australia’s Property Market In October 2021?

- Out of all the capital cities, Perth recorded its first negative result, with values falling 0.1%. On the other hand, Brisbane is the fastest-growing city, with values rising 2.5% in October 2021.

- Sydney and Melbourne’s growth rates have dropped since their peak monthly growth of 3.7% and 2.4%, respectively, in March 2021.

- Housing values outperformed the unit market. The annual results revealed Sydney’s housing values rose 30.4% compared to a 13.6% rise in unit values. However, the gap is less prominent in regional areas of Australia.

- Property listings rose and have outweighed buyer demand. The total number of houses and units for sale in October 2021 was 141,786. This is a 6.8% increase in active listings from mid-September.

- Over the four weeks ending October 2021, 47,070 newly advertised properties entered the market. This is a 22.7% increase from last year and 5.2% above the five-year average.

- National rents were up 0.7%. Over the past three months to October 2021, the largest rent rise was in Sydney, at 2.4%, followed by Brisbane, regional Queensland and regional NSW at 2.3%. In Perth, rental growth slowed abruptly. It has risen only 0.6% over the past three months.

- Across combined capitals, unit rents underperformed compared with house rents. Unit rents rose 1.6%, compared with a 1.9% rise in house rents over the three months ending October 2021.

- Gross rental yields fell to a record low of 3.27%. Sydney and Melbourne experienced the lowest rental returns, of 2.44% and 2.74%, due to low rental growth and a high rate of capital gain.

Australia’s housing market is still experiencing growth, but there are clear signs the market is cooling. Housing demand might not be able to keep pace with increased listings, due to tighter lending conditions and worsening affordability.

This rapidly evolving market is why you need the help of mortgage experts to help finance your property goals. Before stringent credit policies are enforced and house prices rise too high, get approved for a home loan right now. Call us on 1300 889 743 or enquire online.