Updated: 29 May, 2025

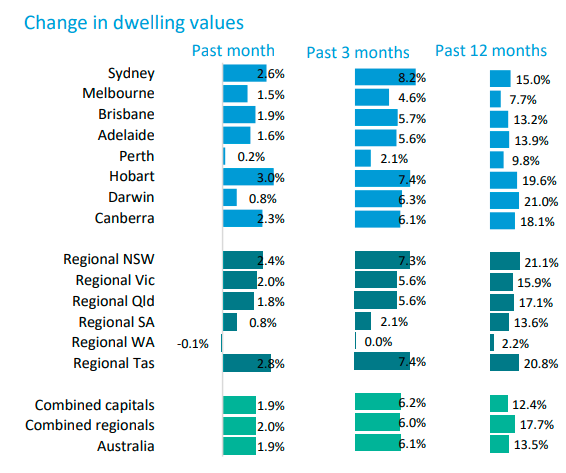

Property prices rose 1.9% in June. All of the capital cities experienced a rise in property values. Perth had the smallest increase, at 0.2%, and Hobart’s 3% was the largest. Sydney had a 2.6% increase while Melbourne had a 1.5% increase. Regional Australia’s 2% price growth was slightly higher than capital cities’ 1.9%.

CoreLogic Head of Research Eliza Owen says, “This is the highest annual rate of growth across the Australian residential property market since April 2004, when the early 2000s housing boom was winding down after a period of exceptional growth. However, there are some markets where performance is starting to ease more notably.”

Capital cities Versus Regional Australia

The three capital cities with the highest annual rate of growth in 2020-21 were Darwin (21%), Hobart (19.6%) and Canberra (18.1%). The three regional areas with the highest annual rate of growth were Regional NSW (21.1%), Regional Tasmania (20.8%) and Regional Queensland (17.1%).

The growth was led by demand-side factors like high consumer confidence, low mortgage rates and a fall in unemployment. Amid such strong demand, the amount of advertised stock was relatively low. This combination buoyed the market and created urgency among buyers.

Property Market Trends In 2020-21

- Sales volume remained high through the end of the financial year. In 2021, CoreLogic estimates, there were approximately 582,900 transactions nationally. This is the highest sales volume observed since February 2004.

- Sales volume was highest in Sydney, at 110,064, then Melbourne, at 89,234, and regional Queensland at 80,549.

- The amount of stock on the market is low, despite a rise in new listings. There were approximately 126,320 fresh listings advertised for sale in the three months to June, 7.9% above the previous five-year average for the June quarter. However, sales were much higher, with 197,450 national sales in the same period. The total advertised stock levels were 25% below the five-year average.

- Rent values are experiencing strong growth. In the year to June, rent values increased to 6.6%, which is the strongest appreciation since February 2009. Darwin had the highest annual growth in rent values, increasing by 21.8%.

- Even rental markets that were heavily affected by COVID are showing a recovery trend through June. Across Sydney, unit rents were 1.1% lower over the year to June, but that is up from a recent trough, when they were down 5.7% in the year to December 2020. Similarly, in Melbourne, the annual change in rent values to June was -6.4%, which is a recovery from the year-on-year decline of 8.2% in the 12 months to March 2021.

What are the signs of slowdown?

- While the monthly change of 1.9% is above the decade average of 0.4%, the growth rate in May 2021 was higher, at 2.2%. Canberra was the only capital city to experience an increase in property value from last month, climbing to 2.3% in June from 1.7% in May.

- Growth in capital cities is losing momentum. This is most evident in Perth and Darwin. Perth’s growth rate averaged 1.4% between January and May 2021, but fell to 0.2% in June, while Darwin averaged 2.1% January to May but fell to 0.8% in June 2021. These cities had the lowest ratio of sales to new listings among the capital-city markets.

- The high end, or upper quartile, of the property market experienced a softer growth rate. Across the top 25% of property values in the combined capital markets, growth in June was 8%, which is down from 9.2% in the three months to May. CoreLogic’s Owen says, “This easing in the pace of growth at the top end of the market is another clear sign of a shift in momentum. The rest of the market tends to follow movements at the high end, and this is the first time in nine months that the high-tier growth rate has not accelerated.”

The question now for Australia’s property market is how long the lockdowns will continue and what measures the government will take.

“The question is not what impact short lockdowns have on the housing market; there seems to be relatively little impact. Instead, outcomes for the housing market and the industry will depend on how long lockdown conditions last across parts of the country, and whether some of the institutional responses offered through 2020 are reinstated if an extended lockdown occurs,” Owen explains.

Affordability constraints remain an issue for first home buyers. Fortunately, there are options available for this cohort, from government grants and schemes to no deposit and low deposit home loan options.

Investors are making a comeback to the market and Home Loan Experts has a panel of lenders that can provide competitive interest rates on investment loans.

Are you buying your first home or expanding your property portfolio? Our mortgage brokers are here to help. Call us on 1300 889 743 or enquire online today.