Updated: 09 May, 2025

It is the third consecutive month of decline for Australia’s property values.

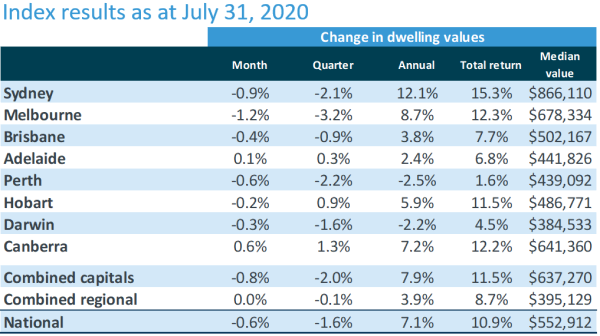

CoreLogic’s home value index dropped 0.6% over July 2020 and the median property value is $552,912.

Sydney and Melbourne are still leading the decline in home values at 0.9% and 1.2% respectively. Among the capital cities, only Canberra and Adelaide recorded a rise in dwelling values of 0.6% and 0.1% respectively.

Regional markets are showing resilience to falling values. Across the combined regional areas, housing values remained the same in July, compared to a 0.8% decline in combined capitals.

What are the signs of recovery?

- Real estate agent activity has recovered to the same levels as 2019 after drastically dropping around 60% in mid-March 2020.

- The number of newly advertised properties increased to 46%. New capital city listings are tracking 8.9% higher than in 2019.

- The national home sales estimates over the past three months since May 2020 tracked 2.9% higher than the same period in 2019.

However, due to the second wave of the coronavirus in Melbourne, consumer sentiment weakened in July 2020. The Westpac-Melbourne Institute Index of Consumer Sentiment fell 6.1% to 87.9 in July from 93.7 in June.

The auction markets showed recovery through June, however, it has weakened in July as Melbourne went back to lockdown. There is a rise in withdrawn auctions in Melbourne.

What happened to Australia’s rental market in July 2020?

Sydney and Melbourne’s rental demand has been affected by border closures.

According to Lawless, “Some inner city areas of Melbourne and Sydney have seen rental listings more than double since March due to the combined effect of temporary migrants departing, and overseas arrivals, including foreign students, stalling. Compounding this weak demand position is the surge in construction activity and investment over previous years, which has added to inner city rental supply.”

In contrast, Perth and Adelaide are showing strong rental conditions due to low levels of investor participation and less ‘investment grade’ construction which has balanced rental supply and demand.

What is the outlook for the property market?

The repayment holidays will end in March next year and the government stimulus packages announced during coronavirus will also taper soon.

Lawless believes the medium term outlook for the housing market remains skewed to the downside.

He comments, “Urgent sales are likely to become more common as we approach these milestones, which will test the market’s resilience. Similarly, the recent concerns of a second wave of the virus and the potential for renewed border closures and stricter social distancing policies are likely to further push consumer sentiment down. This is likely to weigh on both home buying and selling activity more broadly.”

Is stamp duty being abolished in NSW?

No, the New South Wales (NSW) government has not abolished stamp duty.

However, they did announce major changes in stamp duty for first home buyers.

First home buyers in NSW are exempt from paying stamp duty if they’re buying a new home valued up to $800,000. Previously, the threshold was at $650,000.

The new NSW stamp duty exemption for first home buyers comes into effect from 1 August 2020.

Is it a first home buyer’s market?

Besides the stamp duty changes in NSW, there are other government and state schemes that will help first home buyers get onto the property ladder.

- The First Home Loan Deposit Scheme is a nationwide scheme that helps first home buyers with a 5% deposit buy a home without paying for Lenders Mortgage Insurance.

- The $25,000 HomeBuilder grant helps those who want to build their first home.

- First home buyers who are either buying or building a new home might also be eligible for the First Home Owners Grant.

Learn more about the grants and schemes available for first home buyers in 2020.

We have also created an extensive first home buyer guide that will help to navigate the process of buying your dream home.

Our mortgage brokers have helped many first home buyers realise their dreams of home ownership. Call us on 1300 889 743 or fill in our free assessment form.