Updated: 29 May, 2025

Australia’s housing market values are rising at the fastest rate in 17 years!

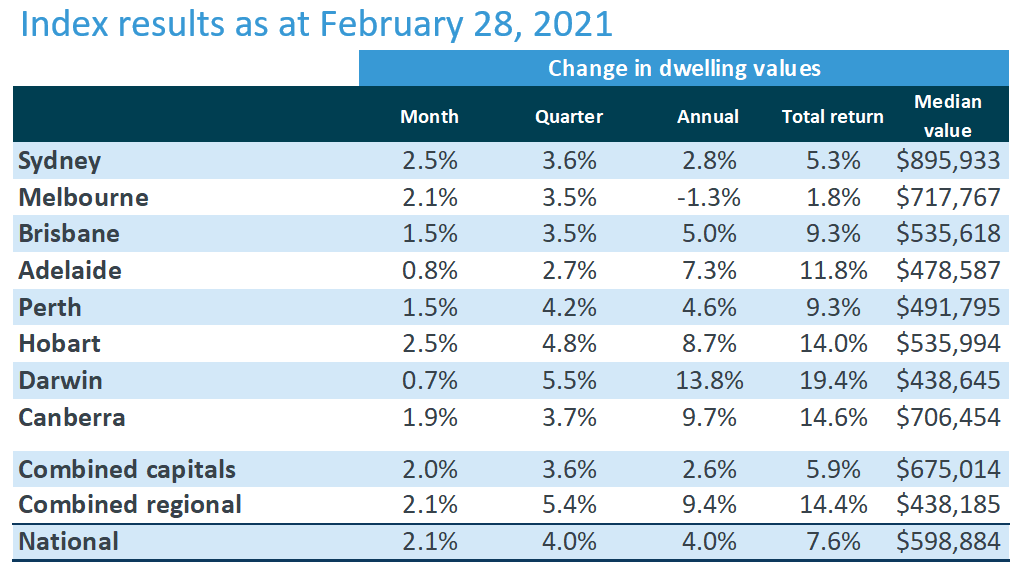

The home value index for February 2021 was 2.1%, which is the largest month-on-month change in the index since 2003.

According to Tim Lawless, Head of Research at CoreLogic, “The last time we saw a sustained growth period where every capital city and rest of state region was rising in value was mid-2009 through to early 2010, as post GFC stimulus fueled buyer demand.”

Housing values are rising in each capital city and regional areas. Sydney and Melbourne are the strongest performing markets, with a 2.5% and 2.1% lift respectively.

The regional markets are outperforming their capital counterparts. The combined regional index is 9.4% higher while the combined capital city index is up 2.6%. There was less decline in housing values and regional areas showed a stronger and earlier growth trend in the second half of 2020.

Why are house prices rising?

- The record low interest rates will remain, which provides confidence to property buyers.

- Australia’s economy is recovering. According to the Australian Bureau of Statistics(ABS), the Gross Domestic Product (GDP) figures for the three months to December 2020 show the economy recovered by 3.1%.

- Home loan commitments rose by 10.5% in January 2021 to $28.8 billion. The increase is driven by first home buyers and investors.

- The advertised supply levels are low. In the 28 days ending 21 February, the number of properties advertised for sale was 26.2% below 2020 levels.

- There is a mismatch between housing demand and supply. The property listings are not able to absorb the burgeoning demand from people.

- Even if new listings track higher over the coming months, buyer demand might also increase and the total advertised stock levels will remain low.

If you want to get a home loan, it’s best to get pre-approved so you’re ready to secure the right property under tight supply conditions.

Just how hot is the property market?

Gareth Aird, Head of Australian Economics at CBA predicts:

- Property prices in Sydney and Melbourne will rise by 7.5% and 7% respectively over 2021.

- Brisbane house prices will increase by 16.6% by December 2022.

- Perth prices will grow by 17.7% while Perth is expected to lead the price growth with 18.7% over the next two years.

He further adds that Australia is heading towards a housing market boom and lending could rise over the next six months due to:

- Record low mortgages

- V-shaped labour market recovery

- Borrowing rates are the single biggest driver of prices in the short run remain below the property yield in most markets across Australia

CBA’s research is reliable as they have data on the number of people who get pre-approved in each suburb. Approximately 1 in 4 home loans in Australia goes to CBA. The major bank also has information on its customers’ bank accounts and where they are spending.

A case study

We recently attended an auction with a customer, who had his eyes on a 4 bedroom property in Ashfield. The property was located close to a park and had good schools.

The agent had advised a price guide of $1.8 million, which later changed to $2 million since the house across the road sold for $2 million in October. This is known as “comparable sale” and can be used to work out the price of the property.

The customer had a limit of $2.3 million, and he even went $50,000 above his limit.

The bidding went past $2.4 million and the property was finally sold at $2.5 million.

Vacancy rates are falling

Vacancy rates are falling throughout Australia. They are particularly low in some cities like Adelaide, Perth and Hobart.

| City | Vacancy Rate (December 2020) | Vacancy Rate (January 2021) |

|---|---|---|

| Sydney | 3.6% | 3.2% |

| Melbourne | 4.7% | 4.4% |

| Brisbane | 1.8% | 4.4% |

| Perth | 0.9% | 0.8% |

| Adelaide | 0.7% | 0.7% |

| Canberra | 1.1% | 0.8% |

| Darwin | 0.9% | 0.8% |

| Hobart | 0.6% | 0.6% |

| National | 2.2% | 2% |

Figure: National residential rental vacancy rate, SQM Research

When vacancy rates are low, it means that there are not many properties for rent, which means:

- Rents generally rise significantly.

- Some renters that are able to will buy, increasing house prices.

- Investors buy properties in these areas, increasing house prices.

There could be a few roadblocks on the way, with the reduction in fiscal support from the government (JobKeeper and JobSeeker) and home loan deferrals ending in March 2021.

However, the property market is on the trajectory to rise in the coming months.

The change in lifestyle during the pandemic allowed for remote working capabilities, which means people are favouring to buy in regional locations that are affordable.

How to get approved for a home loan?

Properties are selling fast across Australia.

You need to be prepared to act fast and get a mortgage and organise your finances before another buyer snaps up your dream home.

- If you’re a first home buyer, take advantage of the various government schemes and grants like the First Home Loan Deposit Scheme, stamp duty exemptions and First Home Owners Grant.

- Saving for a 20% home deposit is an indication to the lender that you are financially responsible and serious about getting approved for a home loan. However, with rising property prices, there are low deposit home loan options available.

- If your parents own property in Australia, having a guarantor allows you to borrow up to 105% of the property value. You don’t need to save for a large deposit.

- Take note of your credit score as lenders will look at your credit file to ensure you can make mortgage repayments at the interest offered.

- Ideally, you should be in your job for at least 6 months before applying for a home loan.

Our mortgage brokers are experts in helping seasoned investors and first home buyers. Call us on 1300 889 743 or enquire online.