Updated: 29 May, 2025

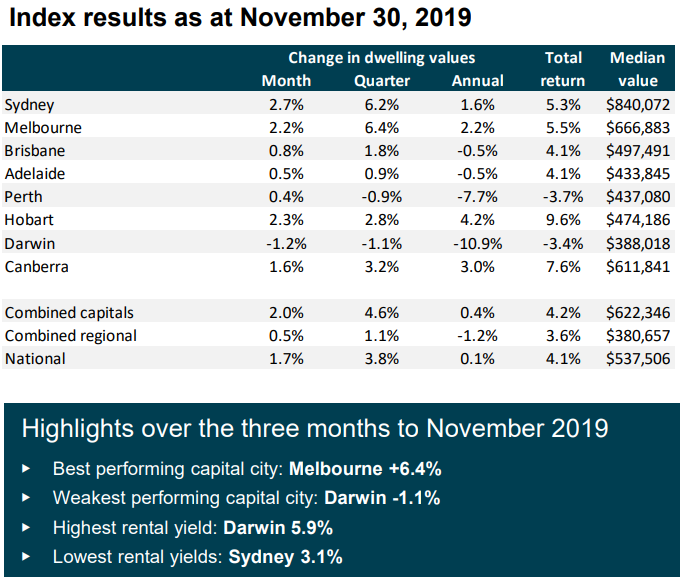

According to CoreLogic’s national Home Value Index, Sydney dwelling values saw the largest increase in a month since 1988, growing by 2.7% in the month ending November.

This is the most significant single increase over a month in Sydney prices since 1988.

In addition, Melbourne housing prices also tracked a substantial increase of 2.2% this month.

On the back of the rapid recovery led by Sydney and Melbourne, the national home value index entered positive annual growth territory for the first time since April 2018, growing by 1.7%.

Source: CoreLogic

What’s happening in Sydney and Melbourne?

Although housing values are increasing across the board, the recovery trend is most concentrated in the premium sector of the market.

This is very evident in Sydney and Melbourne, where the top quartile of the market is outperforming the broad middle of the market and lower quartile.

For example, Sydney’s top quartile was up 7.4% over the last three months, compared to a 3.8% increase in the lower quartile.

Similarly, Melbourne’s top quartile was up 8.1% compared with a 4.2% rise in the lower quartile in the same period.

Moreover, Brisbane, Perth and Darwin are also on a similar trajectory where the premium properties are outperforming lower value properties.

The performance of the premium market is being attributed to a combination of values falling more in this sector during the downturn, as well as adjustments to serviceability which has boosted borrowing capacity across the board.

As housing becomes less affordable in these high-end markets, demand is likely to ripple outwards to the more affordable areas.

Perth market sees its first month to month increase since 2018

In a significant turn for the Perth property market, Perth saw its dwelling values increase by 0.4% month to month for the first time since 2018.

Over the past 13 years, Perth went from being the most expensive capital city to now being the lowest among the capital cities. Dwelling values are down a cumulative 21.3% since the mind 2014, through to the end of this month.

This is great news for first home buyers looking to get their foot into the property market in Perth. However, on the other side, Perth homeowners have seen a reduction in their equity.

What’s driving this growth?

According to CoreLogic, the upward mobility of prices is largely being propelled by:

- Relaxation of serviceability (borrowing power) adopted by APRA;

- The three cash rate cuts by the RBA;

- And the removal of uncertainty around taxation reform after the election.

Moreover, factors such as:

- Low levels of advertised stock creating urgency in the market as buyers demands pick up;

- Prospect that interest rates are likely to fall further over the coming months;

- And the improvement in housing affordability following the recent downturn are supporting this growth.

Regional prices trudge up

The combined capital cities index, which includes Sydney, Melbourne, Brisbane, Adelaide, and Perth is 4.6% over the past three months.

Whereas, the combined regional index is trudging upwards slowly – it saw an increase of 1.1% over the past 3 months.

The best performing of the broader regional areas over the past 3 months were:

- Regional Tasmania which saw the most robust growth with values up by 2.2%;

- Regional Queensland grew by 1.8%;

- Regional New South Wales grew by 1.2%; and

- Regional Victoria grew by 1.0%.

Annualised national index up 15.3%

Annualising the growth rate of the past three months shows the national index growing by double-digit annually (+15.3%). Moreover, Sydney and Melbourne dwelling values are tracking around the mid-twenty per cent range for annualised capital gains.

This rapid recovery and the introduction of the upcoming First Home Loan Deposit Scheme in January 2020 will likely contract housing affordability further in 2020.

We’re also expecting a rush of first home buyers seeking to take advantage of the government scheme come January.

Don’t miss out on your ideal property!

Getting pre-assessed for a home loan by our mortgage brokers means you’ll be ahead of the curve.

One of the most common reasons we see prospective buyers miss out on their ideal property is because they start looking for properties without a pre-approval.

Whether you’re looking to buy now or after the holidays, avoid the rush and get your home loan pre-approved today.

Talk with one of our specialist mortgage brokers by giving us a call on 1300 889 743 or fill in our short assessment form to get started.