In early 2021, we observed two auctions to buy property in Sydney’s inner west, in which our customers participated. These are great case studies of real transactions, so we thought it would be great to share what we recommend our buying property at auction guide.

Auction Of A House In Ashfield

The first auction we witnessed was for a house in Ashfield, New South Wales. The house had four bedrooms, one bathroom and no parking space; it was on 527m2 of land. It was visibly in terrible condition; there was significant termite damage, and it needed a minimum of $200,000 in essential repairs. Our client, Abbey, was probably going to have to spend $400,000 in total to renovate and repair the property if she won the bid.

Initially, the real-estate agent’s auction guide price was $1.8 million to $2 million. A week before the auction, this changed to $2 million.

The agent had given all the buyers a building report, but it didn’t mention the termite damage. Abbey had arranged her own report and knew there was a lot of work to be done before the house would be ready to live in.

The auction clearance rate in Sydney was extremely high, at 84%, at that time.

The house across the road from the property had sold for $2 million four months ago. That house is on 688m2 of land; it is larger than the one Abbey was looking to buy.

The market had risen significantly in the four months since, making the sale of the current property at a higher rate possible.

Abbey had estimated the property value to be $2.1 million-$2.2 million but as the market was rising, she was willing to bid up to $2.3 million. An online valuation estimated the home was worth $1.76 million, with a max value of $2.025 million.

It was visibly in terrible condition; there was significant termite damage, and it needed a minimum of $200,000 in essential repairs. Our client, Abbey, was probably going to have to spend $400,000 in total to renovate and repair the property if she won the bid.

Initially, the real-estate agent’s auction guide price was $1.8 million to $2 million. A week before the auction, this changed to $2 million.

The agent had given all the buyers a building report, but it didn’t mention the termite damage. Abbey had arranged her own report and knew there was a lot of work to be done before the house would be ready to live in.

The auction clearance rate in Sydney was extremely high, at 84%, at that time.

The house across the road from the property had sold for $2 million four months ago. That house is on 688m2 of land; it is larger than the one Abbey was looking to buy.

The market had risen significantly in the four months since, making the sale of the current property at a higher rate possible.

Abbey had estimated the property value to be $2.1 million-$2.2 million but as the market was rising, she was willing to bid up to $2.3 million. An online valuation estimated the home was worth $1.76 million, with a max value of $2.025 million.

However, as the property had not been sold in 50 years, those prices hadn’t taken into account the house’s poor condition nor the rising market. So, we knew to ignore the online valuation.

However, as the property had not been sold in 50 years, those prices hadn’t taken into account the house’s poor condition nor the rising market. So, we knew to ignore the online valuation.

How Much Did The House Sell For?

Two buyers really wanted that home! Abbey bid up to $2.35 million, which was a little over her limit. Eventually, the property sold for $2.5 million. This auction was so out of control that the newspaper ran a story on it.

What Lessons Can We Learn From This Auction?

- Sometimes, other bidders want a property more. You must learn to let go.

- When the market is hot, getting a bargain probably isn’t possible. In fact, you will probably have to pay more than you think to win.

- Get your own building report!

- Don’t rely on an online valuation. Use comparable sales to value a property.

Auction Of An Apartment In Lewisham, Nsw

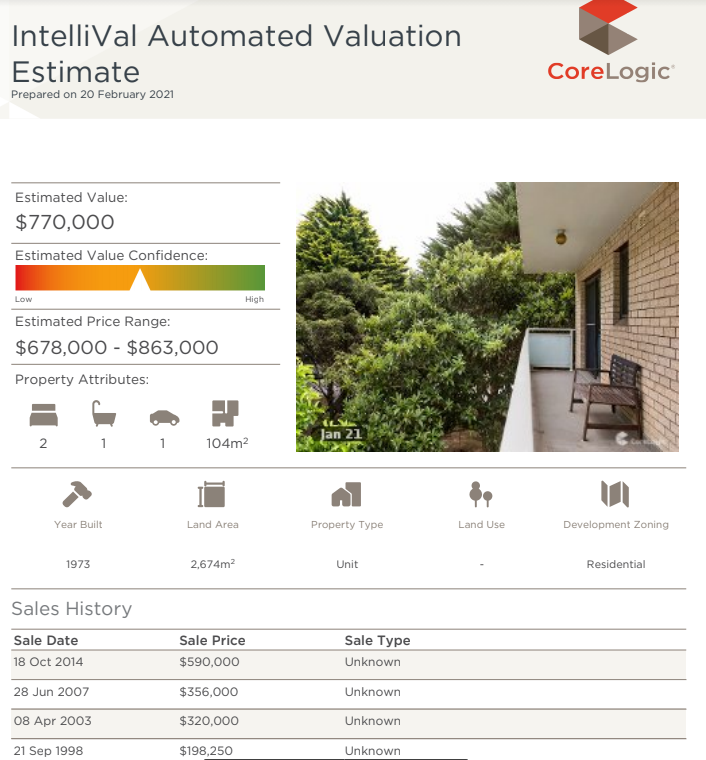

The second auction we witnessed was with another client, Fred, who was bidding on an apartment in the Sydney suburb of Lewisham. The unit on auction was on the main road, which can get really busy during the peak hours. But the apartment was at the back of the complex, so noise wasn’t a major issue. This is common for apartments on main roads; the fronts have noise issues while the back of the complex is usually fine. The location was great – close to a large park, with the train station and shops a five-minute walk away. The property market was extremely hot, with an auction clearance rate of 84%, as with the first auction we discussed. An online valuation estimated the unit was worth $770,000. But Fred knew not to rely on this. He did a strata report on his own and then called the strata manager. He discovered this list of problems:

He did a strata report on his own and then called the strata manager. He discovered this list of problems:

- The balconies needed major repairs.

- The pool was leaking and would cost $500,000 to be replaced.

- There was a legal battle between the strata corporation and the company that built the pool, which was costing the owners a fortune.

- The strata corporation was broke. It had no money at all. It would need to issue a special levy to all owners. We estimated that whoever owned this unit was probably going to need to pay a levy of $100,000.

How Much Did The Apartment Sell For?

The property went for a whopping $791,000! The successful bidders had asked for a copy of the contract only the day before the auction, so it was unlikely that they had time to obtain a strata report. Unfortunately, they probably didn’t know what they were getting into. As Fred left the auction, he spoke to a neighbour and found there were even more problems with the apartment:- All the big trees at the front of the building were dying. It would cost a fortune to remove them; not to mention the years it would take for new trees to grow.

- Most of the owners couldn’t afford to pay the special levy. Lots of them wanted to sell.

What Lessons Can We Learn From This Auction?

- If you’re buying an apartment or townhouse, get a strata report.

- If a property has a lot of problems, don’t assume the other buyers know about them. They may be bidding much more than you because they don’t know all the problems with the property.

- Talking to neighbors can be extremely helpful.

- Again, do not rely on an online valuation.