Most lenders require you to pay Lenders Mortgage Insurance (LMI) if you are borrowing more than 80% of the property value. We’ve outlined ways you can get approved for a home loan with no deposit or a low deposit.

What Is A No-deposit Home Loan?

It is a home loan where you get approved for 100% of the property value, meaning you don’t have to pay a deposit. The most common zero-deposit home loan in Australia is a guarantor home loan.

With most lenders, you will require a deposit of at least 5% for most loans; however, there are ways to avoid paying a deposit.

Use our no-deposit calculator to see which loan deposit option best meets your needs.

No-Deposit Home Loan Options

These options are available to you when you don’t have a deposit.

105% guarantor loan

This is the best zero-deposit home loan option available in Australia. With a guarantor home loan, a guarantor (in most cases your parents) will put up their property as security so you can borrow with no deposit.

- You can borrow 105% of the purchase price.

- You don’t need any savings.

- Your parents (or other guarantor) must provide a guarantee, secured on their property.

Do I Qualify?

- Your guarantor must have equity in their property to cover the guarantee.

- Your guarantor (usually your parents) typically must be working. Retired guarantors are accepted by only a few lenders.

- Your guarantor’s property must be in Australia.

You can learn more about this option on our guarantor mortgage page.

Why Should I Choose A Guarantor Home Loan?

For borrowersNo-deposit loans have become an attractive option for many people who do not have the funds to contribute towards a deposit on a mortgage. You can borrow the full purchase amount plus the money needed for stamp duty or any other associated costs. Lenders Mortgage Insurance (LMI) is not required, saving you thousands. In many cases, the interest rates are exceptionally low.

For GuarantorsGuarantors have a fixed liability and can be pursued only for the guaranteed amount, making this a more secure option. The guarantee can be secured by either their property or a term deposit.

Guarantors do not have to make the scheduled loan repayments and the guarantee can be released upon request if, at a later date, the borrower satisfies standard bank criteria and the bank agrees. Normally, this is when the borrower owes less than 80% of the value of their property.

OwnHome’s Deposit Boost Loan

The Deposit Boost Loan is a 15-year loan that covers the 20% deposit you need to buy a home. You can borrow up to 100% of the property without paying LMI.

The loan is available for first-time buyers and owner-occupiers.

Do I qualify?

- You are an Australian citizen or permanent resident.

- You have saved at least 2% of the property value as savings.

- You have an excellent credit history.

- Your income can service the Deposit Boost Loan and the mortgage.

- You have funds to cover the starter fee (2% of the property value) and the upfront costs of buying property.

You can learn more about this option on OwnHome’s website.

At Home Loan Experts, we may refer you to trusted partners like OwnHome for additional services or products. We might receive compensation for these referrals. However, our referral doesn’t imply an endorsement or guarantee of OwnHome’s services or products. Before engaging with OwnHome, we recommend researching and considering your needs. Your decisions based on our referrals are at your discretion and risk.Use Equity As A Deposit

If you already own a property, there are lenders who accept home equity as a deposit.

- If you have sufficient equity, then you don’t need any savings at all

- You can use your existing equity as a deposit by refinancing.

- Some lenders will offer you a cash rebate to refinance.

- We can value your property for free right now!

Simply give us a call on 1300 889 743 or enquire online for free and we’ll let you know if you qualify.

If you don’t qualify for either of these no-deposit home loan options, then you can check out these low-deposit options.

Low-Deposit Home Loan Options

If you can save at least 5% of the property value as a deposit, low-deposit home loan options are available. These options range from government schemes to gifted deposits and personal loans.

First Home Guarantee

The First Home Guarantee is a nationwide program to help first-home buyers purchase a property with a deposit as low as 5% without having to pay Lenders Mortgage Insurance. From 1 July 2023 – 30 June 2024, 35,000 places are available.- A minimum deposit of at least 5% is needed (most lenders require the deposit to have been accumulated through genuine savings).

- Single first-home buyers earning up to $125,000 a year and couples earning up to $200,000 a year are eligible. The definition of a couple has been expanded to family members or two friends living together.

- This scheme extends eligibility not only to single parents with at least one dependent child, but also to legal guardians, including aunts, uncles, and grandparents. You must intend to move into and live in the property as your principal place of residence (i.e., the scheme is for owner-occupiers).

- The applicant must be an Australian citizen or permanent resident.

You can read the full details of the scheme on our First Home Guarantee page.

Gifted Deposit Home Loan

Your parents can provide you with a lump sum as a gift with no strings attached, and you don’t have to pay them back.

- Your parents can provide you with 5% – 15% of the purchase price as a non-refundable gift.

- Some lenders will consider your loan even if you didn’t save the deposit yourself.

- About 60% of first-home buyers receive help from their parents.

You can read more about this option on our no genuine savings page or gifted deposit page.

Personal Loan As A Deposit

You could use a personal loan as a home deposit; however many lenders do not favour this option, as you would then need to keep up with repayments for both the personal loan and home loan.

- You need a minimum deposit of 5% of the property value.

- A high income to afford both repayments.

- You can borrow up to 95% of the purchase price plus the personal loan.

- Little existing debt (car loans, high credit-card balances, etc).

- You must have a clear credit history.

This isn’t suitable for all people. We recommend that you speak with your parents about a guarantor loan before you consider this option.

Some lenders will allow a borrowed deposit and do not require genuine savings but you may need some funds of your own to cover stamp duty and other expenses. If you do not have any savings of your own then you are unlikely to be approved.

You can read more on our personal loan as a home deposit page.

Using Super To Buy A House

If you have over $300,000 in superannuation and wish to buy a property for investment purposes, you can set up a self-managed superannuation fund (SMSF) to buy a property. Here’s how it works:

- SMSF Loan: You can borrow up to 80% of the purchase price using your SMSF.

- Eligibility: You cannot use your superannuation to buy a property in your own name; it must be in your SMSF’s name.

- Investment Property: You can only buy an investment or commercial property, not a property to live in.

Discover if you’re eligible to buy an investment property using an SMSF. Keep in mind that this is a complex strategy that requires financial advice before you begin.

Alternatively, you can use the First Home Super Saver Scheme (FHSSS) to save for your first home. Here’s how it works:- Contributions: Eligible individuals can contribute up to $15,000 per year and $50,000 in total to their super fund for this purpose.

- Tax Concessions: The contributions and earnings in your super fund are taxed at a lower rate, helping your savings grow faster.

- Withdrawal: Apply at the Australian Taxation Office to withdraw these voluntary contributions, along with associated earnings, to help buy your first home. This process can take up to 20 business days.

The FHSSS offers tax concessions and a tax-effective way to save for a home deposit, but it’s important to consider carefully the eligibility criteria, contribution limits, and potential tax implications.

Apply For A Shared-Equity Scheme

A shared-equity scheme or arrangement is when an equity partner acts as both the lender and investor in a property. The partner contributes a portion of the purchase price of the property in exchange for an interest in the property. For most of these shared-equity schemes, a deposit of at least 5% of the property price is required.

There are different types of shared-equity schemes and arrangements available in Australia.

- Under the nationwide Help To Buy scheme, the government contributes 40% for new builds and 30% for existing properties.

- There are also state and territory-wide schemes available.

Pros And Cons Of No-Deposit Home Loans

This kind of loan has various pros and cons, which can depend on individual financial circumstances, the broader economic environment, and the specific terms and conditions of the loan.

Pros:- Accessibility: Buyers can enter the property market without having to save a substantial deposit, making homeownership accessible to those who may not have much in savings.

- Faster home ownership: Without the need to save for a deposit, buyers may be able to purchase a home sooner.

- Investment opportunities: Some may use this type of loan to invest in property earlier and potentially benefit from property appreciation.

- Potential for government assistance: There may be government grants or incentives available to first-time buyers that can be combined with no-deposit loans.

- Stricter eligibility requirements: Lenders often require a strong credit history, stable employment, and evidence of financial responsibility.

- Limited choices: Not all lenders offer no-deposit home loans, limiting the available options.

- Higher risk of negative equity: If property values decrease, you might owe more on the mortgage than the property is worth, since you started with no equity.

- Potential for over-borrowing: Without a deposit to limit the size of the loan, there might be a temptation to borrow more than is financially comfortable, leading to potential financial strain in the future.

How To Get Approved For A Home Loan Without A Deposit

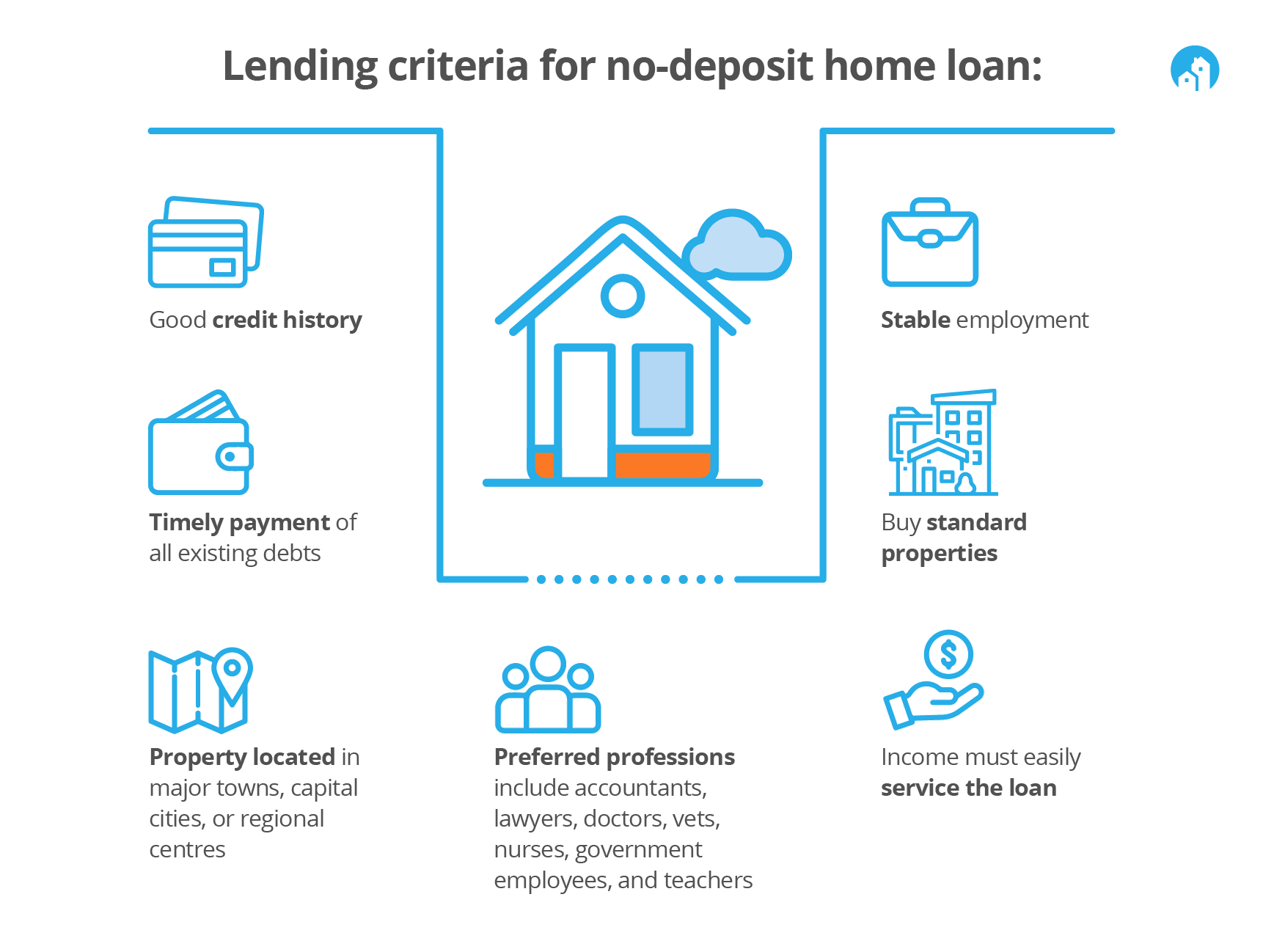

What Are The Lending Criteria For No-Deposit Loan?

Here’s what lenders look at when assessing your no-deposit home loan application:

- Credit history: You must have a perfect credit history with Equifax. No Australian lenders will make an exception to this policy if LMI approval is required.

- Repayment history: You must be paying all of your current debts, such as credit cards, personal loans and rent on time.

- Location restrictions: You must be buying in a major town, capital city or regional centre. One of our lenders is willing to consider anywhere in Australia but most lenders are strict about the location.

- Property type: You must be buying a standard type of property, such as a house, townhouse, unit or vacant land. As a general rule, unusual or unique properties are not acceptable.

- Stable employment: Your employment situation must be stable and ongoing.

- Income: Your income must be high enough that you can easily service the loan. You cannot borrow to your limit with a high Loan-to-Value Ratio (LVR) mortgage.

- Profession: Professionals such as accountants, lawyers, doctors, vets, nurses, government employees and teachers are highly sought after by lenders because they are well known to be a lower risk than people in other professions. You don’t need to be a professional to get approved but it helps.

Not sure whether you will be approved for a 100% home loan?

Call us on 1300 889 743 or enquire online for free today to find out!

FAQs

Other options are available if the no-deposit home loan options don’t work for you. You can follow these tips to increase your chances of approval.

- Prepare to buy: Use our prepare to buy program to get ready to qualify for a mortgage.

- Save a 5%-10% deposit: Save 5%+ of the purchase price in a bank account in your name. Make regular contributions.

- Don’t change jobs: When you are borrowing close to 100% of the purchase price, lenders like to see that you are stable and that you have been in your job for some time.

- Pay your bills on time: If you don’t have much of a deposit, lenders will lose a large amount of money if you can’t make the repayments. For this reason, they look especially closely at your credit file and rental history.

It depends on your local market and risk tolerance.

In a rising market, opting to borrow 100% with a guarantor or 95% with Lenders Mortgage Insurance (LMI) might prove more cost-effective than waiting to accumulate savings. The risk of waiting lies in potentially missing out on capital gains during the saving period.

In a stable or declining market, however, it may be prudent to save a 5%-10% deposit for a 95% loan if you prefer not to use a guarantor.

You can use our calculator to decide if you should buy now or save a larger deposit.

Yes, you can borrow 100% and consolidate your other debts such as HECS/HELP, personal loans and credit cards provided you have a guarantor who is working and allows you to use their property as additional security for your loan.

There are no lenders in Australia that can lend more than 100% of the purchase price with a no-deposit loan that is not supported by a guarantor.

We can compare the options from our panel of lenders for you. With help from our experts, you’ll get approved for the amount you need at a competitive interest rate.

Homeowners: First-time buyers and owner-occupiers have the best chance of getting a 100% home loan with a guarantor. Banks see them as lower risk because they’re more likely to maintain the property and repay on time.

Investors: Investors can also get no-deposit loans with a guarantor, but expect stricter conditions due to higher risk. In some cases, this requirement might be waived if you’re buying your first investment property while living with your parents. Lowering your loan amount to 95% expands your lender options. If you already own property, you can take out its equity and use it as a deposit.

Yes! No-deposit home loans with a guarantor are available with almost all loan features including:

- Professional package discounts

- Waived application, valuation and monthly fees

- Fixed rates (1 year, 3 years, 5 years, 10 years and 15 years)

- 100% offset accounts

- Unlimited extra repayments (variable rate loans only)

- Redraw facilities

- Interest only repayments (up to 15 years)

- Weekly, fortnightly or monthly repayments

- Vacant land, building or construction loans

Note that no-deposit finance is not available with a line of credit loan. You have the option to switch loan types at a later date when the guarantee has been removed.

Before you undertake a comparison of different no-deposit loans you should complete a needs analysis with a mortgage broker. You should consider which features will give you the biggest benefit and which you are likely to use.

Not as high as you think! No-deposit home loans with a guarantor are often available at competitive interest rates and even application fee waivers for some loans.

We also may be able to help you access various deals, like professional packages and basic loan discounts, through our network of lenders.

The key to securing a favourable rate is applying with a lender that’s actively pursuing customers needing 95% to 100% financing. As mortgage brokers, we’re familiar with these lenders and can guide you effectively.

For personalised assistance, reach out to us at 1300 889 743 or submit a free online enquiry.

The cost of LMI varies, primarily influenced by your lender and the loan amount. Opting for a guarantor loan allows you to bypass LMI costs entirely, leading to big savings. In the absence of a guarantor, you’ll likely need LMI. Generally, LMI fees for loans below $300,000 are quite reasonable. However, for loans over $500,000, the LMI cost can rise steeply. They are typically around 4% of the total loan amount.

You can use our LMI calculator to estimate the cost of LMI.

The lenders in our panel that offer no-deposit home loans with the help of a guarantor include:

- ANZ

- BankWest

- CBA

- St. George Bank

- AMP

- Westpac

- Rams

If you’re looking to secure a home loan but have only a $5,000 deposit, this amount isn’t sufficient. Lenders generally require a minimum deposit of 5% of the property’s purchase price. For example, you’d need at least $22,500 for a property valued at $450,000, in addition to funds to cover purchasing costs like stamp duty and mortgage fees.

How Do I Apply For A No-Deposit Home Loan?

As your specialist no-deposit mortgage broker, we are here to help!

Contact us at 1300 889 743 or enquire online and we can then discuss your situation with you to see if no-deposit finance with the help of a guarantor is suitable for you.

We can also help you prepare to apply for a home loan in the future if you don’t qualify for a loan at the moment.

If you’re eligible, then we can usually organise an approval over the phone with one of the lenders on our panel.

Still have questions? Feel free to comment below and we’ll get back to you as soon as possible.

Our Popular Guides For No-deposit Home Loans

Guarantor Home Loans

Which lenders specialise in expats?

Guarantor Home Loan Calculator

Can you borrow 105% of the purchase price.

No Savings History

Which banks don’t need a large deposit?

95% Home Loans

Can I get a discounted rate?

90% Home Loans

Am I eligible for a 90% loan?

85% Home Loans

Can I avoid LMI with an 85% home loan?