What Is The Victorian Homebuyer Fund?

It is a shared equity scheme that helps you buy a home in Victoria with a deposit as low as 5% of the purchase price. The Victorian Government will contribute up to 25% of the purchase price for an equity share. You avoid paying Lenders Mortgage Insurance (LMI), which is normally applicable when you borrow more than 80% of the property value. You don’t have to be a first-home buyer to qualify. The fund is available for those who want to become owner-occupiers of property in Victoria.How Does The Victorian Homebuyer Fund Work?

The Victorian Government will make a financial contribution for an equity share in the property. You buy back the government’s share over time. The government will allow eligible participants with a contribution of 25%, and you will need to contribute a minimum of 5% of the purchase price as a deposit. A participating lender will provide the remaining amount. Note: Aboriginal and Torres Strait Islander participants require only a 3.5% deposit and are eligible for a 35% shared equity contribution. The government will not charge interest on its contribution but will take its proportional share of any capital gain or loss should you sell your home.

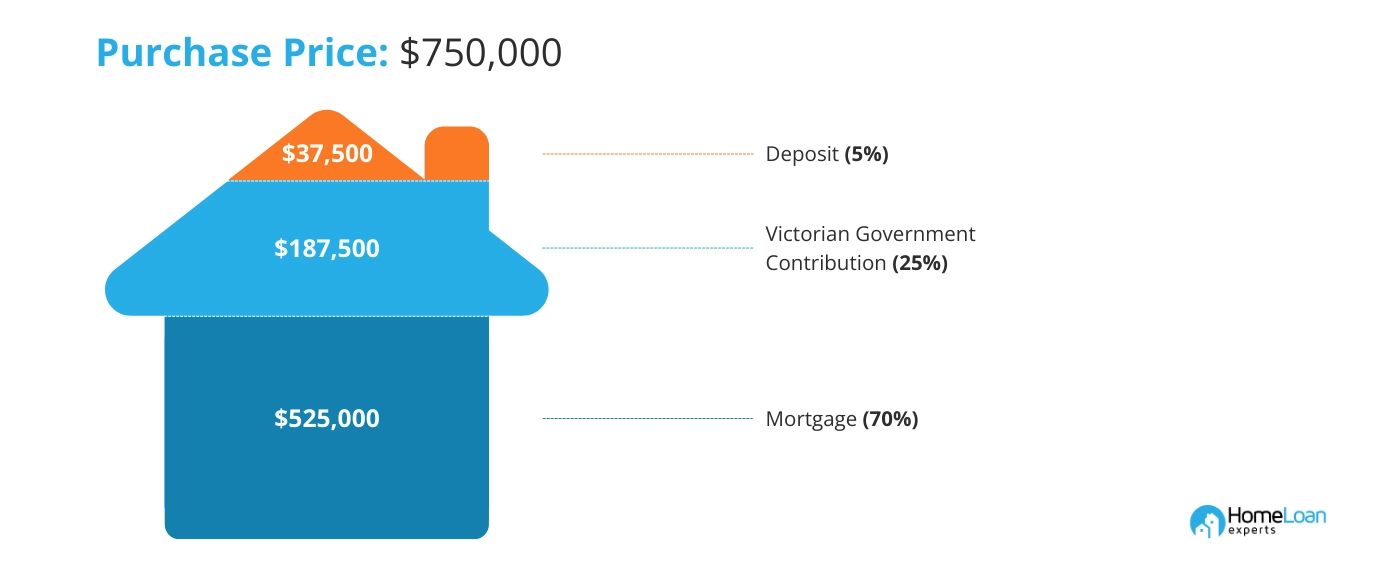

An Example Of How It Works

You’re buying a home valued at $750,000 through the Victorian Homebuyer Fund with a home loan from a participating lender. You start with a 5% deposit, which equals $37,500. The Victorian Government contributes $187,500, equivalent to 25% of the property value. The $525,000, or 70% of the property’s value, is secured through a home loan with a participating lender.

The 360° Home Loan Assessor provides a comprehensive breakdown of the savings you can achieve by accessing the fund. By factoring in the government’s contribution, you can understand the reduced deposit amount required, making homeownership more accessible and affordable.

What Are The Pros And Cons Of The Victorian Homebuyer Fund?

| Pros | Cons |

|---|---|

| You can buy a home sooner with a smaller deposit. | There are only a handful of participating lenders. |

| You save thousands on LMI fees. | The Victorian Government owns a portion of your property. |

| You might also be eligible for other first-home specific grants and stamp-duty exemptions or concessions. | You have to buy back the government’s share of the property to gain that equity. |

Am I Eligible For The Victorian Homebuyer Fund?

To be eligible for the Victorian Homebuyer fund, you must:- Be 18 years old at the time of settlement

- Be an Australian citizen or permanent resident; New Zealand citizens are also accepted

- Save a minimum deposit of 5% (3.5% for Aboriginals and Torres Strait Islanders) of the property price

- Earn a gross income of $130,485 or less annually for single applicants or $208,775 or less for joint applicants

- Live in the property as the principal place or residence

- Become registered owners of the property

- Have an approved loan from a participating lender; you must have sufficient funds to pay for all the costs of buying the property

- Purchase your property from a vendor who is a relative

- Own an interest in any land in Australia or overseas (even as a trustee of a trust or beneficiary under a trust)

- Be a shareholder in any corporation (other than a publicly traded company) that owns any land in Australia or overseas.

What Are The Property Price Caps?

The maximum purchase price is $950,000 or less in Metropolitan Melbourne and Geelong or $600,000 or less in eligible regional locations.What type of property can I buy?

It must be a standard residential property:- House

- Townhouse

- Unit

- Apartment

Where Can I Buy Under The Victorian Homebuyer Fund?

The property you buy must be in Metropolitan Melbourne, Geelong or an eligible regional location in Victoria. Here are some areas eligible for the scheme.| Metropolitan Melbourne | Geelong | Regional Victoria |

|---|---|---|

| Southbank Richmond Mount Waverley Croydon Berwick Dandenong Cranbourne Frankston | Hamlyn Heights Geelong Geelong West North Geelong | Bacchus Marsh Bendigo Ballarat Ocean Grove – Barwon Heads |

How Do I Apply For The Victorian HomeBuyer Fund?

- Ensure you meet the eligibility requirements

- Get a participating lender to approve your loan

- Have sufficient funds to pay for all the costs associated with buying a home

- Proof of identification

- Proof of income

- Details of expenses, liabilities and assets

- Participation Agreement

- Scheme Mortgage

- Scheme Mortgage Terms

- Letter of Support

Frequently Asked Questions

How Many Places Are Available?

The scheme will help a total of 3,000 households over time.

Who Are The Participating Lenders?

These are the Victorian Homebuyer Fund lenders:

- Commonwealth Bank of Australia

- Bank Australia

- Bendigo Bank

- Indigenous Business Australia

You cannot use lenders that are not participating in the scheme. Also, note that while you might qualify for the Victorian Homebuyer Fund, you must also qualify under the lender’s criteria for loan approval.

Can I Still Apply For The First Home Owner Grant (FHOG)?

Yes, you can still apply for an FHOG in Victoria. Homebuyer Fund eligibility does not affect your eligibility for the grant/

I Am An Existing Homeowner In The HomesVic Scheme. Can I Swap Schemes?

No, you cannot swap schemes; however, the state government will give you an opportunity to be a part of the HomeBuyer Fund in 2023.

When Do I Need To Repay The Government’s Financial Contribution?

You will repay the government’s financial contribution within the initial duration of the home loan plus 60 days.

You can even make voluntary payments to reduce the state’s share over time. However, during the first two years, the state’s interest must be at least 5%. Voluntary payments must be at least $10,000 and reduce the state’s interest by at least five percentage points.

Can I Refinance My Home Loan?

You can refinance your home loan, subject to approval from the chosen participating lender. You can increase your borrowings only when:

- You’re paying back the government’s share

- Financial hardship provisions have been made

The Homebuyer Fund must approve these.

Can I Renovate The Property?

Yes, you can. But you will need approval from the Homebuyer Fund if modifications:

- Cost $10,000 or more

- Require a building or planning permit

- Involve a structural adjustment to the property

Modifications that reduce the property’s value are not permitted. Your equity share must not fall below what was initially held at the time of purchase due to the modifications.

What Happens If I Was A Single Applicant But Enter Into A Relationship?

If you get married or enter a de facto relationship, your ongoing eligibility will not change. If you want your partner to be a registered owner, you must apply to the SRO for approval.

What If My Income Exceeds The Threshold Over Time?

If your income exceeds the gross annual income for two consecutive years, you must repay the government’s financial contribution in part or whole as your circumstances permit.

How Soon Can I Sell My Property?

You cannot sell your property within two years of settlement without prior written consent from the SRO.

If I Sell The Property, How Are The Proceeds Distributed?

If your property is sold, the proceeds are distributed in this order:

- Your bank to pay off the remaining loan

- The Victorian Homebuyer fund to pay back its share in the property

- Anyone with a legal or equitable interest in the property (council rates)

- You

What If I Don’t Qualify For The Victorian Homebuyer Fund?

There are alternatives available:

- The nationwide ‘Help To Buy’ shared equity scheme that will start in 2024.

- A guarantor home loan

- Low-deposit home loan options

- No-deposit home loan options

- First-home buyers can even get grants and stamp duty exemptions and concessions.