What is MyHome?

MyHome is the Tasmanian Government program that assists eligible applicants with obtaining their own homes by building or purchasing one. With the support of Homes Tasmania, eligible homebuyers can jointly purchase a home, allowing them to become homeowners sooner. MyHome is Tasmania’s shared equity scheme that has replaced HomeShare from 1 April 2022. With the income threshold increased, it is now available to more people and offers more assistance compared to its predecessor. Under this scheme, you share the cost of purchasing a home with Homes Tasmania. The percentage of the home that you own and the amount of Homes Tasmania’s contribution vary depending on the type of property you are looking to buy.What Are The Different Levels Of Equity Contributions?

| Type Of Property | Equity Contribution By Homes Tasmania | Property Price Cap |

|---|---|---|

| New homes (never been lived in), construction on own land, or house and land packages | maximum of $200,000 or 40% of the purchase price, whichever is lower | None |

| Existing Homes Tasmania property | maximum of $200,000 or 40% of the purchase price, whichever is lower | None |

| Existing homes (not Home Tasmania’s) | maximum of $150,000 or 30% of the purchase price, whichever is lower. | $600,000 |

You will have to pay off Homes Tasmania’s share of the property within 30 years. This can be done by either purchasing Homes Tasmania’s share or selling the house, after which each party will get paid their share of the equity. This program is open to all eligible homebuyers in Tasmania.

Am I Eligible?

This program is open to eligible home buyers in Tasmania. To qualify for MyHome, your application must be approved based on certain lending criteria. These include income, property ownership, citizenship, age, the amount of your deposit. You and the property you intend to purchase must also meet the program’s eligibility requirements.Key Qualifying Criteria And Requirements

- Citizenship and legal age

- Assets

- Income

- Deposit Requirements

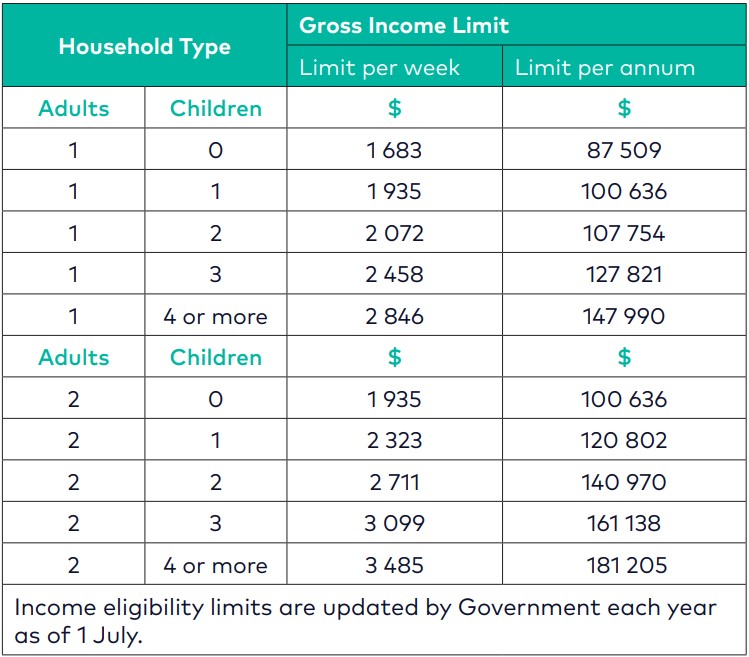

Income Limit as of 1 July 2022

Source: Bank of us MyHome information guide

Source: Bank of us MyHome information guide

Other Eligibility Requirements

You must:- Reside in the purchased house as your primary residence.

- Have the means to pay legal and establishment fees associated with purchasing a property.

- Have the means to pay loan establishment fees and meet ongoing loan repayment requirements with Bank of us.

- Not own or have an interest in any real-estate property other than the land you want to build on under the program.

- Be neither undischarged nor have been discharged, from bankruptcy within three years preceding the application date.

- Not have any outstanding debts to Homes Tasmania.

- Must not have received help under the Home Ownership Assistance Program, Streets Ahead or Homeshare.

Important Note

You are exempt from income and assets test requirements if you:- Are a current tenant of Homes Tasmania property.

- Qualify for the FHOG from the Tasmanian Government.

- Are a first homebuyer and qualify for the first-home buyer stamp duty concession.

- A home or unit that is a newly constructed dwelling.

- Building a new home under a house and land package.

- Building a new home on land currently owned by you with a separate contract to build.

- An existing home or unit.

- An existing Homes Tasmania property

- An ‘off-the-plan‘ purchase.

FAQs About MyHome Shared Equity Scheme

Are All Properties Eligible For MyHome?

Which Lenders Are Available?

How Can I Pay Out Homes Tasmania’s Share Of Equity?

You can choose to buy back the portion of Home Tasmania’s share and have complete ownership. The percentage you’ll need to pay will remain the same from when the contract was made, and you will have to pay the equity earned on the property. The valuation of the home will be calculated on the property’s market value, and the amount that needs to be paid to buy out the property will be the percentage of Homes Tasmania’s share of that property.

For example, 10 years ago, you purchased a new house at $500,000, and Homes Tasmania paid for 40% of the price, which is $200,000. Today, the house valuation is done and it is valued at $800,000. You will need to pay Home Tasmania $320,000 (40% of the house value) to buy back the portion of the equity.

What Happens If I Sell The House?

What If I Have A Current HomeShare Mortgage?

MyHome has replaced the HomeShare program, which was in partnership with Bendigo and Adelaide Bank to help low and middle-income Tasmanians achieve the goal of owning a home.

If you got into the scheme, you will be making your repayments as per usual to Bendigo and Adelaide Bank and continue to meet all requirements according to the HomeShare contract.