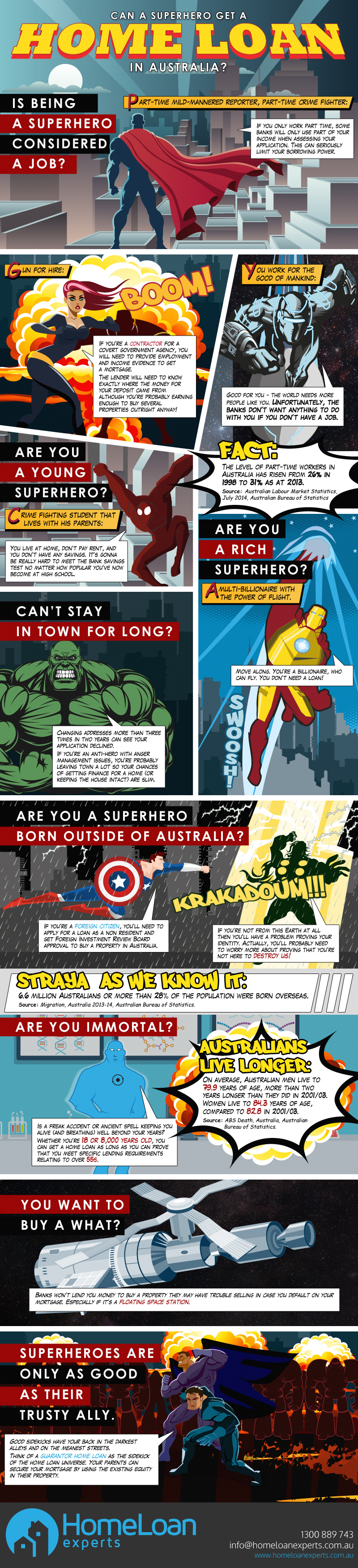

Banks like to make it tough for Australians to get a home loan on the best of days but what if you’re that little bit extra-ordinary?

Despite being the quiet protectors of our pitiful human butts, a superhero would likely get painted with the same crazy brush as any other applicant. Seriously – some banks tend to joke and riddle when it comes to assessing a loan application.

In fact, whether you’re an alien, a bad science experiment or a borderline psychopath, qualifying for a mortgage in Australia is a lot tougher for superheroes than you might think. Strap on your cape for your greatest battle yet.

Do you work part-time, casual or are you a contractor?

Mild-mannered reporter by day, kickin’ butt at night

Working part-time is kind of a big deal in this brave new world, with the level of part-time workers in Australia rising from 26% in 1998 to 31% as at 2013, according to the Australian Bureau of Statistics’ (ABS) Australian Labour Market Statistics, July 2014 report.

If you only work part time, most banks will only use 50% of your income when assessing your application. This can seriously limit your borrowing power.

A gun for hire

If you’re an angry “fixer-upper” for a covert government agency, you may be hard pressed to provide the employment and income evidence you need to get a mortgage.

The lender will also want to know where the money for your deposit came from although you’re probably earning enough to buy several properties outright anyway! Get out of here you maniac (really, you’re scaring me).

Seriously though, if you are a self-employed contractor, specialist lenders will generally look at your application more favourably if you can provide evidence of consistent yearly income. It helps if you work for an industry in demand such as IT or the mining industry.

In addition, you may even be able to get a home loan by providing alternative forms of income evidence.

You work for the good of mankind

Good for you – the world needs more people like you. Unfortunately, the banks don’t want anything to do with you if you don’t have a job.

Are you too young to get a home loan?

So, you’re a crime-fighting teenager and you live with your auntie.

Not to throw a smoke pellet your way but you live at home, don’t pay rent and you don’t have any savings.

It’s going to be really hard to meet the bank savings test no matter how popular you’ve now become at high school.

Are you in a super financial position?

Let me get this straight, you’re a genius multi-billionaire with the technology to fly and shoot rockets from your palms.

Move along, genius (questionable). You’re a billionaire…who can fly. You don’t need a home loan!

Can’t stay in town for long?

Changing addresses more than three times in two years can see your application declined.

If you’re an anti-hero with anger management issues, you’re probably leaving town a lot so your chances of getting finance for a home (or keeping the house intact) are slim.

There are many other aspects of your personal situation recorded on your credit file without you even knowing it, all of which can affect your credit score.

Use our calculator to find out how your credit score stacks up and what you need to do to qualify for a loan.

Are you a non-resident?

If you’re a foreign citizen, you’ll need to apply for a loan as a non-resident and get Foreign Investment Review Board (FIRB) approval to buy a property in Australia.

Australia is actually a great place to live and we welcome immigrants with open arms. In fact, the ABS’ Migration, Australia 2013-14 survey found that around 6.6 million Australians, or more than 28% of the population, were born overseas.

We’re experts in helping non-residents who want to buy a home or invest in Australia so complete our free assessment form to find out how we can help you.

Not from this Earth at all? You’ll not only have a problem proving your identity but you’ll probably need to worry more about proving that you’re not here to destroy us all!

Are you well, well over 55?

Is a freak accident or ancient spell keeping you alive (and breathing) well beyond your years?

Whether you’re 18 or 8,000 years old, you can get a home loan as long as you can prove that you meet specific lending requirements relating to over 55s.

It makes sense since the lifespan of Australians is increasing year after year.

The recent ABS Death, Australia report found that, on average, Australian men live to 79.9 years of age, more than two years longer than they did in 2001/03. Women live to 84.3 years of age, compared to 82.8 in 2001/03.

Out-of-the-box property types and locations scare banks

Your headquarters may be revered by your beloved city but banks will have a lot of trouble selling your floating space station.

Schools, public transportation and the closest CBD are thousands of kilometres below on Earth and it’s not the safest of neighbourhoods to raise kids, mainly because if you step outside you’ll die. Not really a real estate agents’ dream.

Find out what else lenders like to steer clear of when assessing your application by checking out our property types section.

Can your parents act as your guarantor sidekick?

Good sidekicks have your back in the darkest of nights and on the meanest of streets. The best sidekicks will even use the existing equity in their property to secure your mortgage so you don’t have to pay a deposit.

Think of a guarantor home loan as the sidekick of the home loan universe – your parents and their property are the best friends you can have if you want to borrow up to 100% of the property value.

There are no doc options available as well which allow you to borrow 60-70% of the property value.

Even if you’re not a super-powered being, have you ever been knocked by the banks because of any of the above?

Speak to one our expert mortgage brokers and discover how our credit expertise can get your home loan approved where lenders and other brokers have failed.

Call 1300 889 743 or complete our free assessment form today and qualify for the mortgage you need and deserve.