We Have More Calculators To Help You With Your Situation.

How To Use The LVR Calculator

The LVR calculator is a simple tool that can help you understand your Loan-to-Value Ratio. The calculator asks for two pieces of information:

- 1. Property value: The current market value of the property you are buying.

- 2. Loan amount: The amount of money you are borrowing from the lender.

Once you have entered this information, the calculator will determine your LVR, and the result will be displayed in blue.

Click on the orange “Find Out How” button if you would like us to help you with your mortgage.

Enter your email address if you want a copy of your result.

Why Use The LVR Calculator?

The LVR calculator is a useful tool to help you understand your financial situation and to compare different loan options. Here are some of the benefits of using the LVR calculator:- It is free.

- It provides immediate results. With just a few inputs, you can quickly grasp the percentage of the property’s value that will be financing through a loan.

- It shows you whether your LVR exceeds the threshold requiring Lenders Mortgage Insurance. This is important to know, as LMI can affect your upfront costs and ongoing mortgage payments.

- It can help you evaluate your risk profile and take measures to reduce it, potentially leading to better loan terms and interest rates.

The 360° Home Loan Assessor simplifies the process, allowing you to estimate your LVR effortlessly and gain insights into your financial position.

What is LVR?

The Loan-to-Value Ratio (LVR) of your loan is the percentage of the property value that you’re borrowing.

Lenders use the LVR to assess your home loan application, as it indicates the likelihood that they will lose money if you can’t repay your loan.

An LVR of 100% is a very high risk, whereas an LVR of 80% or less is considered safe by most lenders. The majority of lenders will require you to pay Lenders Mortgage Insurance (LMI) if you borrow over 80% LVR.

Looking for ways to borrow at a high LVR?

Check out 5 Ways To Borrow At A High LVR to do just that!

How To Calculate LVR

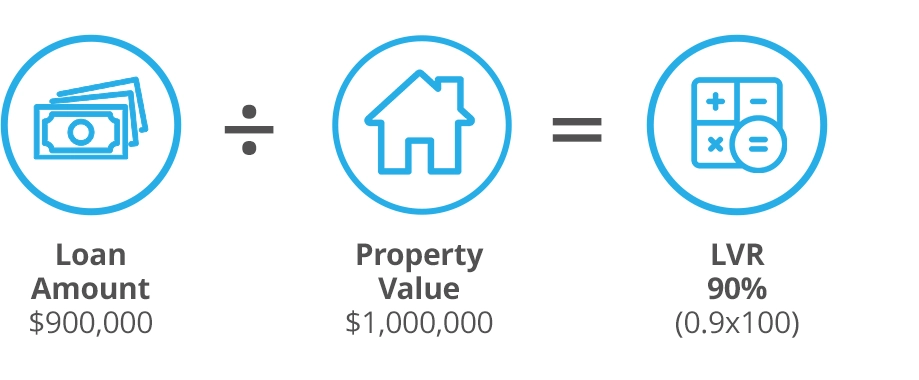

If you borrow $900,000 against a property valued at $1,000,000, then what would your LVR be?

Loan amount: $900,000

Property value: $1,000,000

LVR calculation: 900,000 / 1,000,000 = 90% LVR

This would be considered high-risk LVR by the lender, so they would require LMI for your loan.

Examples Of LVR Calculations in Different Scenarios

If you buy a property for $1,100,000; however, the lender values it at $1,000,000 and you want to borrow $800,000, then what is the LVR?

Loan amount: $800,000

Property value: $1,000,000 (The lower of the purchase price or bank valuation)

LVR calculation: 800,000 / 1,000,000 = 80% LVR

This would be considered low-risk LVR by the lender, so they would not require LMI for your loan.

However, if you have a cooling-off period, you may want to withdraw from the sale or renegotiate the purchase price. Please be aware that the lender is not legally required to tell you that the valuation has come in low.

Sometimes the value of an off-the-plan property can increase between the time when you sign the contract and when the settlement occurs. If over 12 months have passed, then some lenders will ignore the purchase price and rely on the valuation.

However, they can also consider the construction price if it is lower, depending on the lender’s policy.

If you buy a property for $1,000,000; however, the lender values it at $1,200,000 and you want to borrow $900,000, then what is the LVR?

Loan amount: $900,000

Property value: $1,200,000 (purchase price is ignored)

LVR calculation: 900,000 / 1,200,000 = 75% LVR

This would be considered low-risk LVR by the lender, so they would not require Lenders Mortgage Insurance (LMI) for your loan.

In this example, if you wanted to you could increase your loan size and put in less of a deposit.

What if you are buying a property from your family for less than the market value?

This is a common way for parents to help their adult children get into the property market. Some lenders still require you to have a deposit and others do not.

In our industry, this is known as a ‘favourable sale’. The other common methods parents help are with a guarantor loan or a gifted deposit.

If you buy a property for $500,000; however, the lender values it at $600,000 and you want to borrow 100% of the purchase price, then what is the LVR?

Loan amount: $500,000

Property value: $600,000 (purchase price is ignored)

LVR calculation: 500,000 / 600,000 = 83.33% LVR

This would be considered medium-risk LVR by the lender, so they would require LMI for your loan.

In this situation, you are close to an 80% LVR so there are some options that may get you a better deal. This is where a good mortgage broker can help.

You could try to get a bank valuation from another lender, reduce your loan to $480,000 so you are at 80% LVR and avoid LMI, get an 85% no LMI home loan or just pay the LMI premium.

What if you want to buy land for $500,000 and then build a house for $500,000?

Let’s say that the bank completes a ‘Tentative on Completion valuation’ and values your property at $1,000,000 when it is complete. What is your LVR if you borrow $450,000 for the land and $450,000 to build?

Land purchase LVR calculation

Loan amount: $450,000

Property value: $500,000

LVR calculation: 450,000 / 500,000 = 90% LVR

Construction LVR calculation

Loan amount: $900,000 (this includes the land loan)

Property value: $1,000,000 (the value when complete)

LVR calculation: 900,000 / 1,000,000 = 90% LVR

This would be considered high-risk LVR by the lender, so they would require LMI for your loan.

Please be aware that for a construction loan, the lender will consider the property value to be lower than the total cost of the project (land value plus cost of construction) or the Tentative on Completion valuation.

If you are overcapitalising or are paying your builder too much, you may get a low bank valuation.

If your loan is over 80% LVR, then the lender will likely require you to pay an LMI premium. In many cases, you can add this onto your loan in what is known as LMI capitalisation.

If you borrow $900,000 against a property valued at $1,000,000 and you add the LMI premium to your loan, then what would your LVR be? Let’s assume an LMI premium of 3% of the loan amount.

Base loan amount: $900,000

Final loan amount: $927,000 (includes an LMI premium of $27,000)

Property value: $1,000,000

Base LVR calculation: 900,000 / 1,000,000 = 90% LVR

Final LVR calculation: 927,000 / 1,000,000 = 92.70% LVR

Some lenders have limits on the capitalisation of an LMI premium. For example, most lenders don’t allow you to add LMI onto the loan if you are borrowing 95% LVR.

How Will LVR Affect My Home Loan?

Your LVR will affect your home loan in a few ways.- Lenders typically charge higher interest rates on loans with higher LVRs. This is because they are considered to be riskier loans.

- If your LVR is higher, you may have less flexibility with your home loan. For example, you may not be able to make extra repayments or refinance your loan as easily.

- If your LVR is higher, you are more at risk of being “underwater” on your mortgage. This means you owe more on your loan than the property is worth. You could be in a difficult financial situation.

You can learn more on our LVR page.

FAQs

- First, you will typically be able to get a lower interest rate on your loan.

- Second, you will have less LMI to pay, if any

- Third, you will have a smaller mortgage, which will make it easier to manage your finances.

- Boost Your Deposit: The best way to reduce your LVR is to save up a larger deposit. A larger deposit means that you are borrowing less money.

- Explore Guarantor Options: If you have a family member willing to assist, a guarantor loan can help you reduce your LVR. A family member can use their property as security, allowing you to borrow with a smaller deposit and potentially avoid LMI. Most lenders will accept only parents as guarantors.

- Make Extra Repayments: If you have an existing mortgage and are trying to refinance with a lower LVR, try making extra repayments whenever possible. Reducing the outstanding loan balance will increase your equity and contribute to lowering your LVR over time.

- Invest in Home Improvements: Boost your property’s value by investing in strategic home improvements. Enhancing your property can increase its market worth and = your equity, leading to a reduced LVR.