According to QBE’s Australian Housing Outlook 2019-2022, house prices across all the capital cities are set to grow in the next three years.

With Brisbane house prices expected to grow by as much as 20.3%, it may very well be the next property hotspot, it is followed by Adelaide and Darwin which are expected to grow at 12.7% and 7% respectively.

This growth is expected to come from the supply and demand imbalance resulting from:

- A sharp downturn in new dwellings completions and falling new building approvals (down 18% in 2018/19),

- Strong population growth, and

- A combination of increased borrowing power and lower interest rates.

“The future looks a lot brighter for our capital cities. In our largest markets of Sydney and Melbourne, we expect property prices to stabilise as owner-occupiers are enticed back”, according to Phil White, CEO of QBE Lenders’ Mortgage Insurance.

What’s the outlook for house prices in the capital cities?

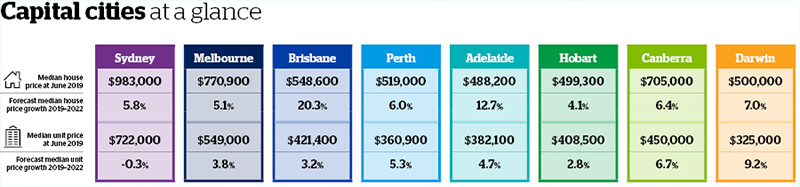

QBE’s outlook for state capital cities’ median house prices over the next three years are as follows:

- Sydney: Sydney house prices are expected to grow at a conservative 5.8% over the next three years. New supply is expected to fall away sharply from 2020 due to current projects being completed and new dwelling building approvals falling. However, despite the rise, house price in June 2022 is forecast to be 13% below the June 2017 peak still.

- Melbourne: Melbourne house prices are expected to see a growth of 5.1% over three years to $810,000 as of June 2022. Despite some easing in borrowing power assessments in 2019, price growths are still expected to be hampered by the rise in dwelling completions and an uptick in vacancy rates.

- Brisbane: Brisbane house prices forecast to grow by 20.3% over this period. After a modest rise in 2019/20, growth is expected to accelerate at an average of 6.4% per annum from 2020/21 as the housing undersupply is absorbed. With underlying demand to remain strong and new supply falling away rapidly, the Brisbane market is forecast to move back towards an undersupply. Is Brisbane going to be the next property hotspot? Let us know in the comments.

- Perth: There are signs now that the worst is over for the Perth market. House prices are expected to grow by a modest 6% over this period. This growth is set to emerge once excess dwelling stock is reduced by 2020.

- Adelaide: House prices are expected to grow 12.7% over the next three years, behind only Brisbane. The majority of this growth is expected on the tail end of this period as dwelling stock are absorbed and the market moves towards undersupply.

- Hobart: House prices in Hobart set to show moderate growth of 4% over this period. After the recent sharp price growth, local incomes will need to rise further before additional price growth can happen.

- Canberra: The national capital city’s house prices are forecast to rise by 6% in the next three years, taking the city median to $750,000. The reintroduction of stamp duty concessions/ exemptions for first home buyers in the Australian Capital Territory from July 2019 is expected to deliver further demand at the more affordable end of the market and help to generate more upgrader activity.

- Darwin: Darwin house prices are expected to see a robust growth of 7.0% during this period. Supply is projected to fall below the underlying demand along with population growth.

What’s the outlook on unit prices in the capital cities?

Unit prices are expected to rise moderately nationwide except for Sydney.

- Sydney: Unit prices in Sydney are forecasted for a -0.3% decline over the next three years. They’re expected to decline before showing signs of recovering from 2020.

- Melbourne: Melbourne unit prices are forecast for modest growth of 3.8%. It is expected to remain relatively flat.

- Brisbane: Overall, unit prices in Brisbane is forecast for a growth of 3.2% over the next three years. Brisbane unit price is forecast for a decline in 2019 before modest price growth is expected to return through 2020.

- Perth: Perth unit price is forecast for a moderate 5.3% growth. Weaker demand from investors and elevated level of unit completions is expected to limit growth.

- Adelaide: Adelaide unit price is forecast to rise by 4.7%. A higher level of unit construction in recent years is expected to mean more modest unit price growth than for houses.

- Hobart: Hobart unit prices forecast to rise by a dismal 2.8%. The low vacancy rate and undersupply in Hobart is expected to drive some demand from the housing market to the unit market.

- Canberra: Unit prices in Canberra are forecast to grow by 6.7%. Unit completions are beginning to ease after peaking in 2019 combined with a strong local economy and population growth; they are expected to lead a moderate increase.

- Darwin: Unit prices in Darwin is forecast to climb by 9.2% in the next three years. Improved unit yields and falling interest rates are expected to attract some investors, however, in the absence of large job-creating industries, population growth and rental demand, growth will be soft.

Demand and supply imbalance

Strong population growth will be the key driver of this growth.

“Net overseas migration is forecast to average a net inflow of 243,000 per annum in the three years to 2021/22, and this is expected to translate to the underlying demand for an additional 204,000 dwellings per annum.

At the same time, new dwelling building approvals fell by 19% in 2018/19 and dwelling completions are subsequently forecast to fall to 163,500 dwellings by 2020/21, which is well below underlying demand.

This could mean some oversupplied markets will tip back into undersupply by 2021/22 creating the potential for a recovery in prices. However, the pace of recovery may be limited”, says the report.

Are you planning to buy your first home?

Last year, more than 110,000 first home buyers entered the property market, and we’re expecting similar numbers to be moving into their first home this year as well.

It is an ideal time for first home buyers looking to enter the market as:

- House prices have now stabilised and are expected to grow. The current house prices are significantly lower than their peak in 2017.

- The current record-low interest rate environment is expected to persist longer; with further rate cuts on the card later this year.

- There’s been an increase of roughly 15% in people’s borrowing power due to the relaxed serviceability rate adopted by the banks.

There’s a catch!

While the recent serviceability changes have boosted borrowing power across the board, the tighter assessment of your living expenses and income adopted by banks can also negatively affect the amount you can borrow.

Whether you’re an investor looking to purchase their next investment property or a first home buyer, our mortgage brokers know exactly which banks have flexible lending policies and can work with you to get the amount you need.

We have almost 40 lenders on our panel, so you’re bound to get the best deal based on your situation.

Please give us a call on 1300 889 743 or fill in our online assessment form today to find out if you qualify.