Most banks and lenders have rolled back to pre-COVID lending policies. They accept most income types.

How will coronavirus affect employment?

A long period of low unemployment has left many Australians unprepared for a period of reduced income.

Thousands of Australians have already lost their jobs, and the federal government estimates that 1 million people could be unemployed as the economic effect of the coronavirus sets in.

As social distancing, work from home and lockdowns affect Australia; it’s likely that many people will not be able to work as usual or will receive a lower income.

In some cases, there may be redundancies followed by an extended period of being unable to find work.

The coronavirus is likely to have wide-reaching and long-lasting effects, so it’s better to prepare now rather than get caught out.

Which income types are likely to be affected?

If you’re a salaried employee receiving a standard wage then unless there’s a significant problem, it’s unlikely that your base income will be affected.

However, some income types are likely to be affected:

- Overtime may be reduced or not received at all.

- Commission income will be lower if salespeople cannot visit customers.

- Bonus income may not be received if staff are unable to hit targets.

- Casual jobs may have no shifts or significantly reduced hours.

- Contractors may face their contract not being renewed.

- Those with seasonal or temporary employment status.

If you are receiving JobKeeper payments, then there are some lenders who will accept it as income.

Which industries will be impacted the most?

Industries such as tourism, hospitality, entertainment, personal services (hairdressers, restaurants, pubs etc.) and personal transport (taxis or ubers) have already been hit hard by the crisis.

The industries most affected by the COVID-19 crisis include accommodation and food services (78 per cent), arts and recreation services (73 per cent), and the retail and wholesale trade sectors (70 per cent), according to a recent survey.

IBIS World released a report on the severity of the impact of COVID-19 on Australian industries. A snapshot can be found here.

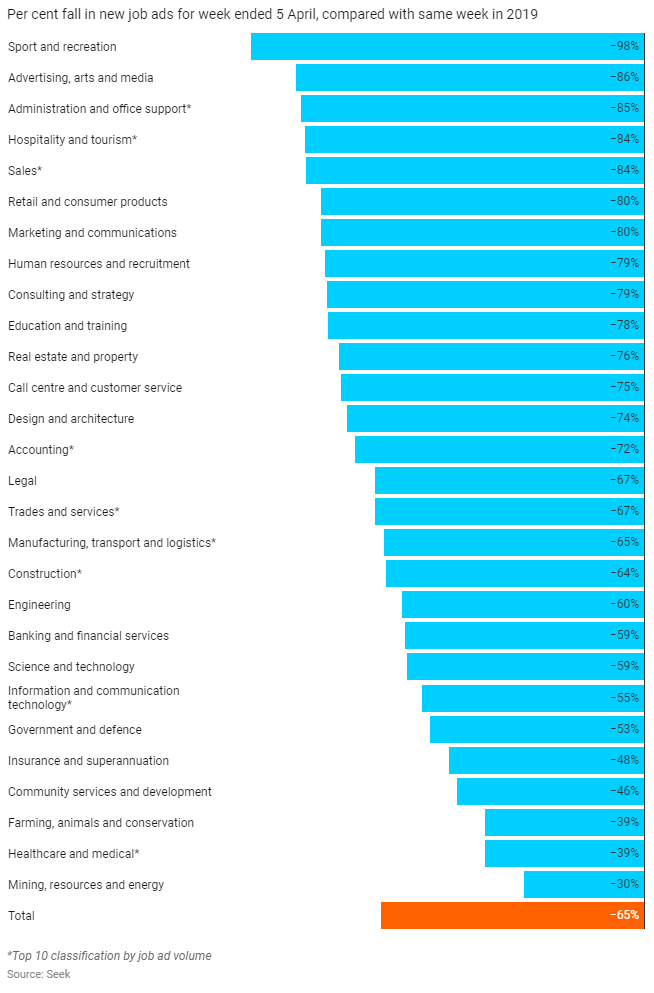

Job ads are down 65% compared to the same period last year

According to the data from job ads website – SEEK shows the following:

What can you do to prepare?

You can prepare by:

- Talking to your employer about their plans and your role.

- Helping your employer plan for this crisis, and if they’re successful, then you will be too.

- Figuring out how to continue working/provide your services remotely.

- Agreeing with other staff for everyone to have reduced hours rather than have one person lose their job.

- Consolidate your debts into your home loan.

- Cut/reduce unnecessary expenses.

- Look for additional sources of income.

- Create an emergency fund.

There is likely to be plenty of work to be done; however, it may be in a different sector or location to your normal employment.

Talking openly with your employer

If your employer is unable to continue doing business, then they may let go of staff.

The best thing to do in these situations is to have an open discussion with your employer and other employees and consider all options:

- Staff taking unpaid leave

- All staff taking a salary cut

- Staff reducing their hours

- Some staff selecting themselves for redundancy

One or more of these options may help you to reduce the impact of this crisis on your coworkers.

Refinancing to create an emergency fund

The best insurance in a crisis is cash in the bank. As we can’t change the past, you may need to consider options such as selling assets.

We’ve written a blog post on refinancing to create an emergency fund. The key is to act now as there is likely to be significant challenges to refinancing later.

This is particularly true for people with irregular incomes as banks rely on your two most recent payslips, and the income shown on them when assessing your application.

Besides, there are significant differences in the way that each lender assess irregular income types with some looking at recent income and others looking at a trend over time or previous financial years.

Email your Home Loan Experts mortgage broker, call us at 1300 889 743 or fill in our free assessment form if you’d like our assistance. Our team is working from home for their safety but will be working overtime to assist our clients.

COVID-19 employment letter template

Usually your payslips, tax returns, group certificates or a Notice of Assessment (NoA) are enough to verify your income.

However, with the uncertainty and the economic impact of the current COVDI-19 crisis, some lenders require a letter of employment for a mortgage to prove your income is stable and ongoing. Lenders also use it to verify the other documents you’ve provided.

You can ask your employer to use this sample letter as a template.

All they need to do is copy it onto their letterhead, amend the details, print, sign and fax it to your mortgage broker.

01/01/2020

To Whom It May Concern:

Re: John Smith

We confirm the following details regarding John Smith’s employment with ABC Pty Ltd:

(Delete sections that are not relevant to you)

- He started working with us on 1/1/2015.

- He is not on probation.

- His base salary was $80,000 per annum gross prior to the crisis.

- He is employed on a permanent full time basis but has been reduced to 4 days a week during this crisis, which reduces his salary to $64,000 p.a.

- He receives overtime / commission / bonus income of approximately $20,000 p.a., this has reduced by 50% during the recent outbreak.

- His base salary and overtime / commission / bonus income will return to normal after this crisis ends.

- We have no intentions of reducing his hours and expect his income to be ongoing.

Should you require any additional information, please do not hesitate to contact Human Resources on 02 0000 0000.

Regards,

(SIGN)

Dianne Johnston

Human Resources Manager

ABC Pty Ltd

Please read the following section on bank requirements for confirmation of employment letters to ensure your letter is accepted!

If you’re using our services to arrange your loan then please ask your employer to fax the letter to us.

Are you facing significant financial trouble?

We’ve written a blog post on financial hardship due to the coronavirus that goes into more detail on all the financial relief options that are available.

Stay safe! Act now!

Unfortunately, the Australian government has been slow to take the health impact of the coronavirus seriously. Just because they haven’t acted, doesn’t mean that you don’t have to.

Above all, social distancing is the most effective way to slow the spread of the virus. Our team is now working from home, and where possible you should discuss with your employer and do the same.

In addition, your employer has a legal obligation to provide a safe place of work, and if need be you should remind them of this. If necessary, take action to force them to take the coronavirus threat seriously.