How much does a $700,000 house in Sydney really cost?

Many people think that the only amount that matters when buying a home is the selling price. In reality, there are of a lot of other costs that you need to be worried about. Don’t fret too much though because we’re here to tell you how to beat these costs and save thousands of dollars!

To explain, let’s look at the costs typically associated with buying a property in Sydney worth $700,000.

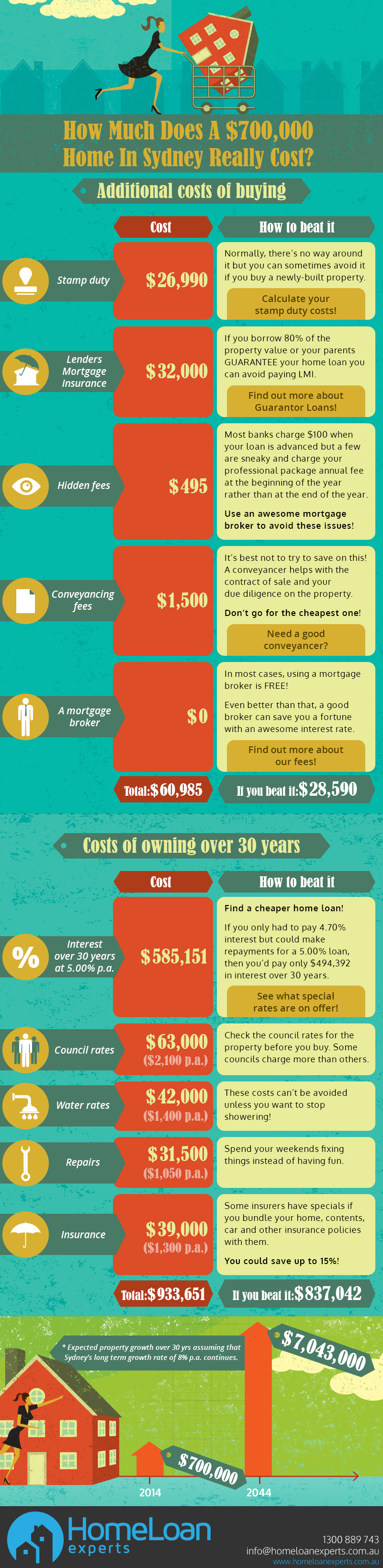

Costs of buying a house

The first cost to consider is stamp duty, a government fee charged on a sliding scale depending on the price of the property. You can expect to pay around $26,990 for a $700,000 home but you can sometimes avoid this fee by buying a newly-built property. You may also have to pay mortgage stamp duty (which has been abolished in most states), transfer fees and even registration fees. To get an estimate of these costs, enter your details in our Property Purchase Costs Calculator.

Depending on the amount you’re borrowing and the lender you apply with, you may have to pay up to $32,000 for Lenders Mortgage Insurance (LMI), a one off fee that protects the bank just in case you default on your mortgage.

This fee is charged on all “risky” loans, specifically when your Loan to Value Ratio (LVR) is over 80%. Thankfully, you can usually avoid paying LMI by having a 20% deposit.

Another way to avoid this charge is by applying for a guarantor home loan. How this works is that your parents guarantee your home loan by putting up their property as security for your mortgage, allowing you to borrow 105% of the purchase price including stamp duty and conveyancing fees. That means you won’t need a deposit and you can even consolidate minor debts into the loan.

Buying a home is also a long process and involves lots of paperwork. This is why a conveyancer or a solicitor is essential since their job is to handle the transfer of the property into your name and other legal requirements pertaining to the mortgage. Because of this it is important that you find a good conveyancer who can help you with your contract of sale and your due diligence on the property. You may have to pay about $1,500 for their services but their contribution can help you save a lot of time and avoid a lot of issues.

Aside from a conveyancer it is also recommended that you hire a good mortgage broker. Brokers are essential to you finding the right home loan. After all, are you prepared to go through all of the zillion loan policies offered by the banks and filter through them to find the best one? What about finding a great interest rate so you can shave more off your repayments? A mortgage broker can do all of this for you and, best of all, most mortgage brokers work for FREE since they get paid by the banks!

In total, your $700,000 house could cost you up to $760,985 but if you’re a smart cookie and use our helpful tips, you could cut this down to $728,590! That’s a saving of more than $30,000, money you could use on your mortgage or to take that Bali cruise that you’ve always wanted to go on.

Costs of owning a house over 30 years

Now that you’ve bought your $700,000 house, have you thought about the costs of owning it for a standard mortgage period, say, 30 years?

As you may know, the interest to be paid on a home loan is the largest cost you’ll have to cover, amounting to about $585,151 for a $700,000 property in Sydney assuming a fixed rate of 5.00% per annum over 30 years. What if you had an awesome mortgage broker who could get you a loan at 4.70%? Would 0.30% really make that much of a difference?

YES! If you only had to pay 4.70% interest but could still make repayments on a 5.00% loan, then you’d be saving $90,759 over the life of the loan. Check out the lowest interest rates that are currently available from our panel of lenders and use that extra cash for your kid’s education fund.

Apart from the costs associated with the mortgage, there are living costs to weigh up. As with any property in Australia, you will have to pay council rates and these fees can cost up to $63,000 ($2,100 per annum) over a 30 year period. Remember though that some councils charge more than others so check out the area before you make a decision.

Water rates round up to about $42,000 over 30 years ($1,400 per annum) but you cannot avoid this unless you want to stop showering!

If you’re good with your hands and have lots of free time, it may be cheaper for you to work on house repairs and maintenance yourself, otherwise it may cost up to $31,500 ($1,050 per annum) over 30 years.

Paying insurance over 30 years can be a real bummer, racking up to around $39,000 ($1,300 per annum) for a $700,000 property. If you’re smart, you can find an insurer who will bundle your home, contents, car and other insurance policies into one package helping you to save up to 15% on your premiums!

Summing up, owning a home over 30 years could cost you up to $933,651 but you can easily reduce this to $837,042 with some clever thinking.

What about property growth?

While you fat stacks with this saved cash, your $700,000 property will be maturing. In fact, according to average property growth estimates, it’ll be worth $7,043,000 by 2044! Isn’t the Australian property market amazing?

Do you have any tips on how to save on property costs? Let us know in the comments section below.

And if you’re ready to get into the Australian property market then call us today on 1300 889 743 or fill in our free assessment form today!

Disclaimer

This page contains general information and the cost figures are an estimate only. The actual cost of buying and owning a home may vary depending on the purchase price, what you buy, where you buy and how you finance your purchase.

We have not taking into account your objectives, financial situation or needs. Before buying a home you should calculate the actual costs that you will pay, having regard to your own objectives, financial situation and needs. Please seek the appropriate legal and financial advice before making any decisions.