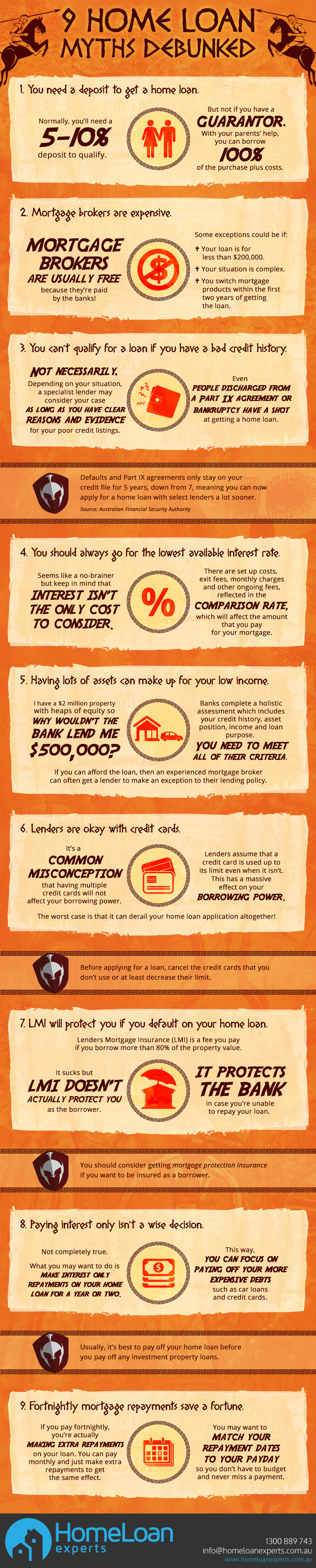

Getting a home loan is a life-changing decision and nothing makes it harder to take the leap than trying to sort home loan fact from fiction.

From the difference of making monthly repayments compared to fortnightly repayments, to the actual cost of using a mortgage broker, here are 9 popular mortgage myths that we’ve exposed.

You need a deposit to get a home loan

Depending on whether or not your stamp duty is waived, you’ll normally need around a 5-10% deposit to qualify for a home loan but not if you have a guarantor.

With your parents’ help, you can borrow 100% of the purchase plus the costs completing the purchase, including stamp duty and conveyancing fees.

You could also use a personal loan to cover your deposit plus these extra costs but getting approved is tough.

You need to be on an exceptional income and have a perfect credit history with minimal to no ongoing debts.

Mortgage brokers are expensive

Mortgage brokers don’t actually charge you anything for their services unless your loan is for less than $200,000, your situation is complex or you switch mortgage products within the first two years.

Brokers get paid by the lender and they offer the same rates as the bank. Essentially, instead of the bank paying their bank manager, they pay the mortgage broker.

You have a bad credit history so you won’t qualify for a loan

Not necessarily.

As long as you have clear reasons and evidence for your poor credit listings, a specialist lender may be able to consider your case.

Even if you’re a discharged bankrupt or have completed a Part IX agreement, you still have a shot at getting a home loan.

You should always go for the lowest available interest rate

This is one of those myths that definitely has some truth to it. Of course, getting a great interest rate is important but it isn’t the only cost you need to consider.

There are home set-up costs, exit fees, monthly charges and other ongoing fees which will affect the amount that you pay for your mortgage.

These costs are reflected in what is known as the comparison rate so check it out to get a clearer picture of how expensive your loan is.

Also, instead of focusing on the lowest rate, you can go for the loan that achieves your goal. Maybe it’s better to choose a lender that:

- Allows a smaller deposit,

- Allows you to borrow more,

- Accepts your employment history, or

- Gives you an offset account.

Having lots of assets can make up for having a low income

Even if you have a two million dollar property with heaps of equity, you’d probably find it difficult to borrow $500,000.

Why?

It’s because banks complete a holistic assessment which includes your credit history, asset position, income and loan purpose, and you need to meet all of their criteria.

Besides, APRA requires the banks to ensure the customer can afford the ongoing repayments on the loan which is why income is the key determiner in a borrower’s’ ability to pay off a home loan.

Lenders are okay with credit cards

Nowadays, many Australians own more than one credit card in order to cope with the higher cost of living.

Unfortunately, having multiple credit cards decreases your borrowing power. Even if you don’t use it, it still makes you look bad.

Not only can it derail your home loan application but lenders assume that a credit card is used up to its limit even when it isn’t.

Home Loan Experts senior mortgage brokers recommends one credit card per person if possible.

LMI will protect you if you default on your home loan

You need to pay Lenders Mortgage Insurance (LMI) when you’re borrowing more than 80% of the property value.

Since you’re the one paying the premium, you might think that this insurance protects you.

Sorry to burst the bubble, but LMI doesn’t actually protect you as the borrower. This insurance protects the bank in case you’re unable to repay your loan.

If you want to be insured as a borrower then you can consider getting mortgage protection insurance.

Paying interest only isn’t a wise decision

If you’ve always thought that making interest only repayments isn’t wise, then that’s just half-true.

Paying just the interest allows you to free up your cash-flow but the benefits of this strategy largely depends on how you use the additional cash.

You may make interest only repayments on your home loan for a year or two while focusing on paying off your more expensive debts such as car loans and credit cards.

Also, interest-only loans are usually a better option for investors wanting to build their property portfolio.

Fortnightly payments save a fortune

If you pay fortnightly, you’re actually making extra repayments.

How?

There are 12 months in a year, meaning 12 monthly repayments. However, there are 26 fortnights in a year, meaning two extra repayments per year if you pay fortnightly.

Through those extra repayments, you can pay off your mortgage faster and save heaps on interest. You can pay monthly and just make extra repayments to get the same effect.

If you match your repayment dates to your payday, you can also avoid missing payments.

Want to separate fact from fiction?

Give us a call on 1300 889 743 or fill in our free assessment form and speak to one of our experienced mortgage brokers.

We understand home loans and we can give you the right guidance in choosing a product that works for you.