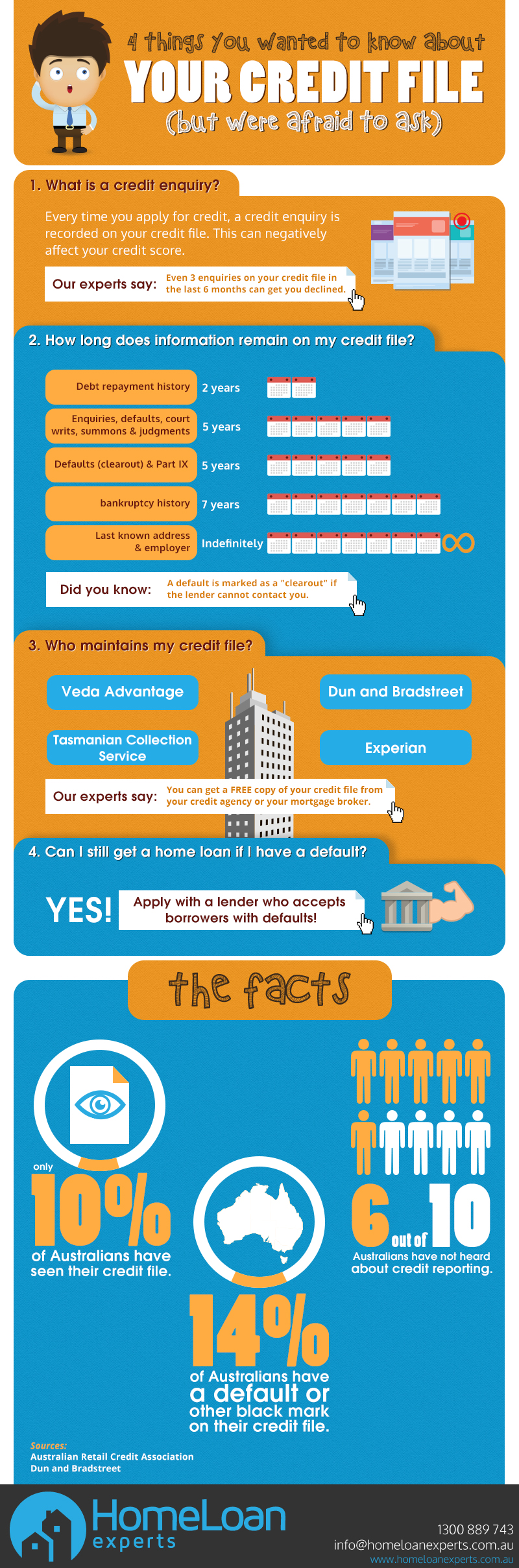

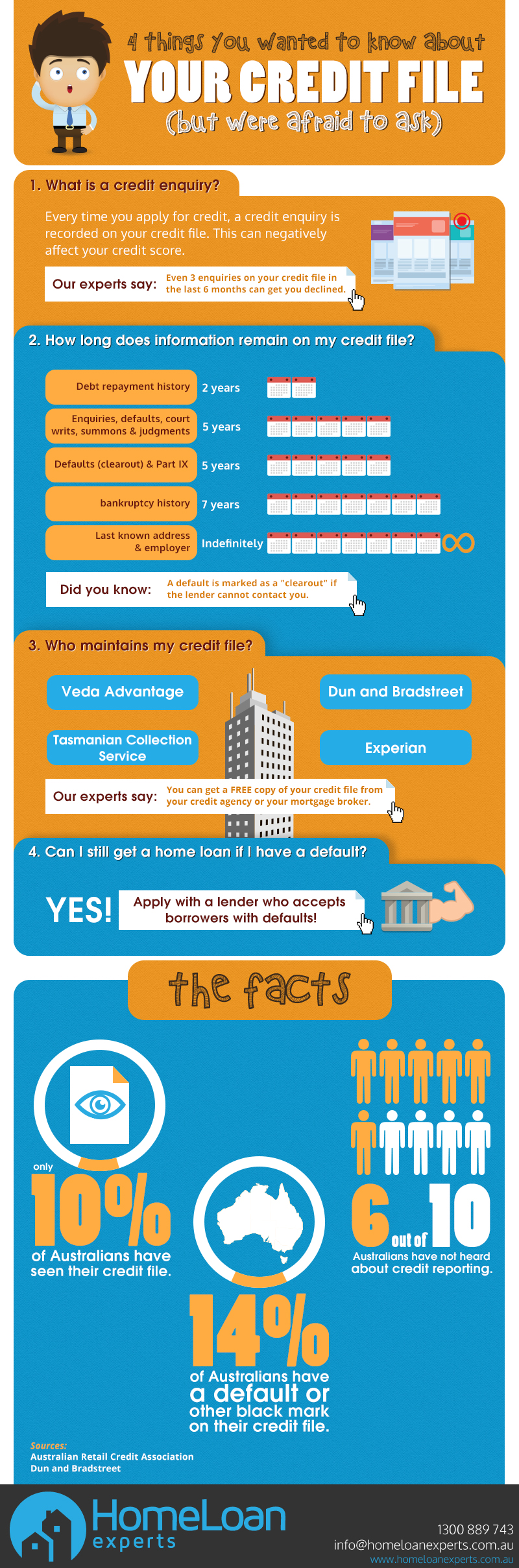

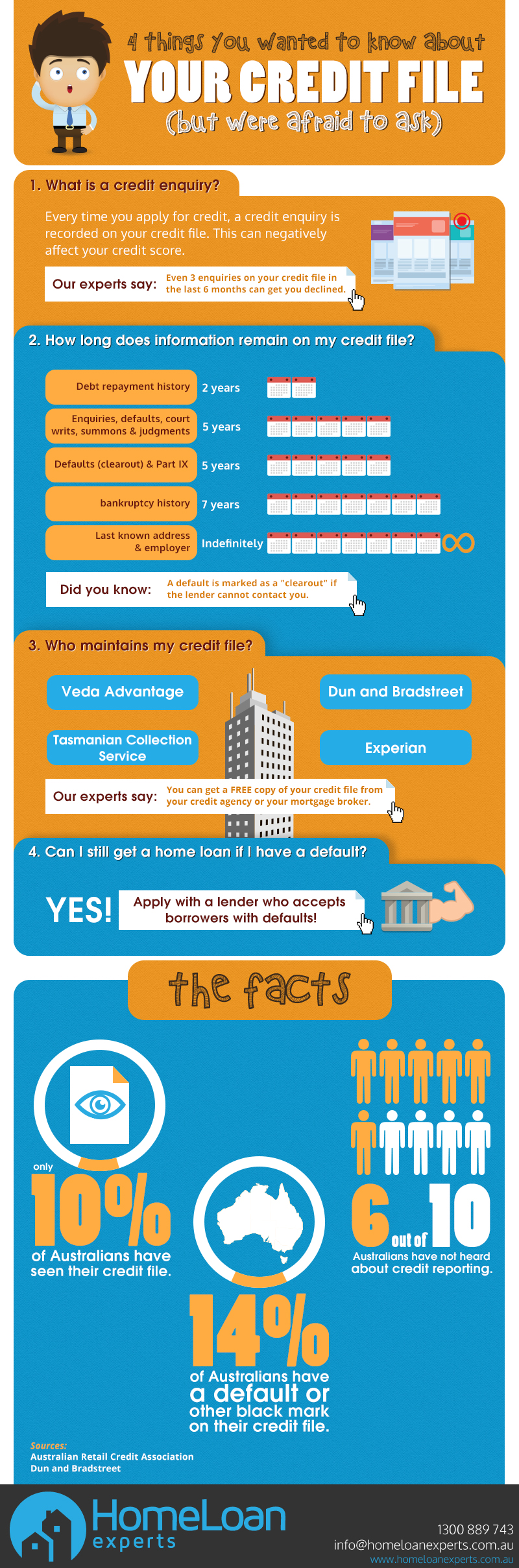

What’s In Your Credit File?

labelCategory: Infographics

No deposit loans

Bad credit loans

Low deposit loans

Investment loans

Guarantor loans

Trust loans

Australian expat home loan

Home Loans for Doctors

Non-resident loans

Unusual employment loans

Waived LMI

Fixed rate loans

Low-doc loans

Home equity loans

Self-employed loans

Home Loans for Lawyers Hot!

See All Home Loans

How much can I borrow calculator

Home Loan repayments calculator

Buy now or save more calculator

LMI calculator

Home buying costs calculator

Credit score calculator

First home grant calculator

Guarantor loan calculator

LVR calculator

Exit strategy calculator

Home equity calculator

Income Tax Calculator

Break Cost Calculator

Refinance Calculator Hot!

360° Home Loan Assessor New!

See all calculators

Lenders mortgage insurance

Credit score

Business loans

Commercial property loan

Genuine savings

Home Loan Interest Rates

Property types

Recommended conveyancers

Blog

Home loan documents

Home loan articles

Lender Reviews

Refinance Rebates

Downloadable resources

First Home Buyers Guide

Coronavirus Home Loan Guides

Home Buyers CourseNew!

How To Buy A House

Mortgage Terminologies

calendar_today

Last Updated: 18th March, 2024

labelCategory: Infographics

local_offerTags: Credit ChecksCredit ScoreDebtsHome Loan

Get a weekly summary of what's happening to interest rates and the property market. Plus get secrets from our brokers on how lenders are changing their products.

Get intelligent content delivered straight to your inbox every Monday!

perm_phone_msg Call us now

email Email us at

info@homeloanexperts.com.au

help Enquire now

Find out if you qualifyHome Loan Experts is a business owned by mortgage broking firm Home Loan Experts Pty Ltd.

ABN: 80 648 606 464

ACN: 648 606 464

location_onHead office

location

Suite 207, 3 Rider Boulevard

Rhodes NSW 2138

maps_home_workBranch office location

Suite 1, Level 1,

120 Erina St, Gosford NSW 2250

markunread_mailboxMailing

address

PO Box 3726 Rhodes

NSW 2138

scheduleOpening Hours

Monday - Friday

8:00 AM - 6:00 PM

phone Local: 1300 889 743

language Overseas: +61 2 9194 1700

print Fax: +61 2 9475 4466

mail_outline Info@homeloanexperts.com.au

help Enquire Now

© 2024 Home Loan Experts Pty Ltd | Credit Representative 540270 is authorized under Australian Credit Licence Number 383528 | ABN: 80 648 606 464